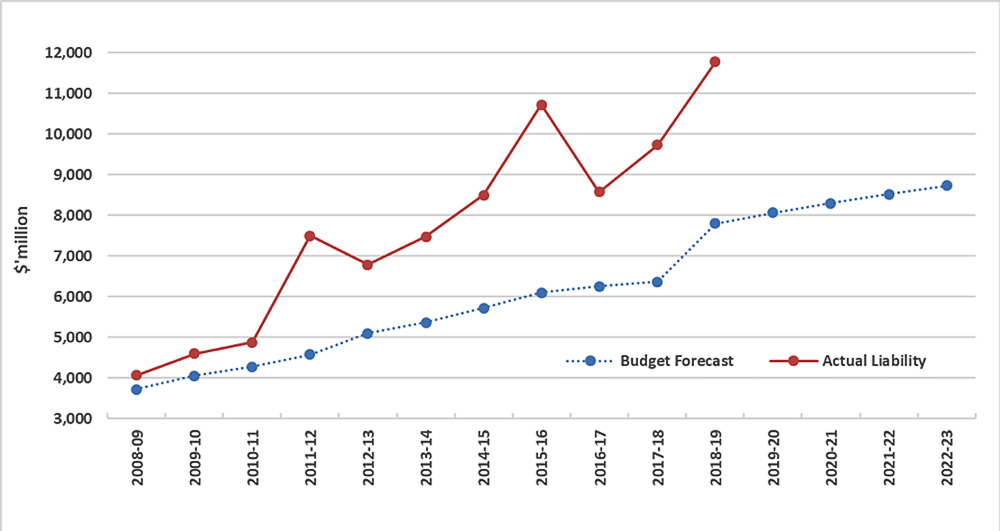

ACT government superannuation liability – Budget forecast and actual liability

“I was stunned… the audited statements showed that the ACT’s superannuation liability was $11.776 billion or 51 per cent higher than the amount reported in the 2018-19 Budget,” writes columnist JON STANHOPE.

A FEW weeks ago I wrote in “CityNews” that along with the deliberate defunding and hollowing out of the ACT’s public health system the issue that concerned me most about the state of affairs in Canberra was the slow and inexorable disintegration of the ACT’s finances.

My fear about the state of the books was prompted by a quick look at the latest ACT Consolidated Financial Statements, which are audited by the ACT Auditor-General, and were tabled in the lead up to Christmas.

Unfortunately, the recently released mid-year Budget review not only validates but has exacerbated my concerns.

My alarm was triggered by the Auditor-General’s assessment of superannuation liability.

I was stunned that the audited statements showed that as at June 2019 the ACT’s superannuation liability was $11.776 billion or almost $4 billion (51 per cent) higher than the amount reported in the 2018-19 Budget, namely $7.804 billion as well as the estimate of $7.812 billion published in June 2019 as part of the 2019-20 Budget.

The Auditor-General explained the basis of the increase in liability from an estimated $7.804 billion to an actual liability of $11.776 billion, in the following terms:

“The higher than expected superannuation liability is predominantly due to the higher than estimated valuation at 30 June 2019 as a result of using two different discount rates for Budget estimates and actual. The discount rate of 5 per cent was applied in the 2018-19 Budget, compared to 1.92 per cent at 30 June 2019. This rate is required by Australian accounting standards, and referenced to the yield on a suitable Commonwealth Government bond.”

The two major questions begged by the Auditor-General’s assessment in relation to such a massive divergence between the ACT government’s estimated and actual superannuation liability are, firstly, how it occurred and, secondly, the impact which such a large and serious “mistake” in a Budget estimate has on our understanding of the true state of the ACT’s finances.

As to how and why it occurred only the Chief Minister and his Labor and Greens Cabinet colleagues can answer that question.

The heart of the question is, of course, the possible motivation the government might have for using a discount rate, which is not consistent with Australian accounting standards, for estimating the quantum of its superannuation liability for inclusion in the ACT annual Budget, particularly when, as the Auditor-General has reported, it underestimates the extent of that liability by around $4 billion.

I will be interested in the answer, though I half expect the government will insist, as is its wont, that it is either someone else’s fault or will claim, as it did when revealing its massive Budget deficit, that there wouldn’t have been a problem except for coronavirus and the recent bushfires.

As an aside, it is fascinating that both the Treasurer and the Under Treasurer signed “Statements of Responsibility” to accompany the audited financial statement.

The Treasurer confirmed in the statement he signed that the statement fairly reflected the financial operations of the territory while the Under Treasurer confirmed that the financial statement was prepared in accordance with the Australian Accounting Standards and the Financial Management Act.

However, it is clear to me from the audited financial statements that the ACT’s actual financial operations and its financial position are markedly different than the picture painted through successive Budgets.

My colleague Dr Khalid Ahmed and I have just completed a detailed analysis of a range of key metrics sourced from the financial statements for the last decade which we have published on the University of Canberra Policy Space blog. The information above is a summary of a small part of that paper at https://www.thepolicyspace.com.au/2020/24/295-deteriorating-finances-of-the-act

.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply