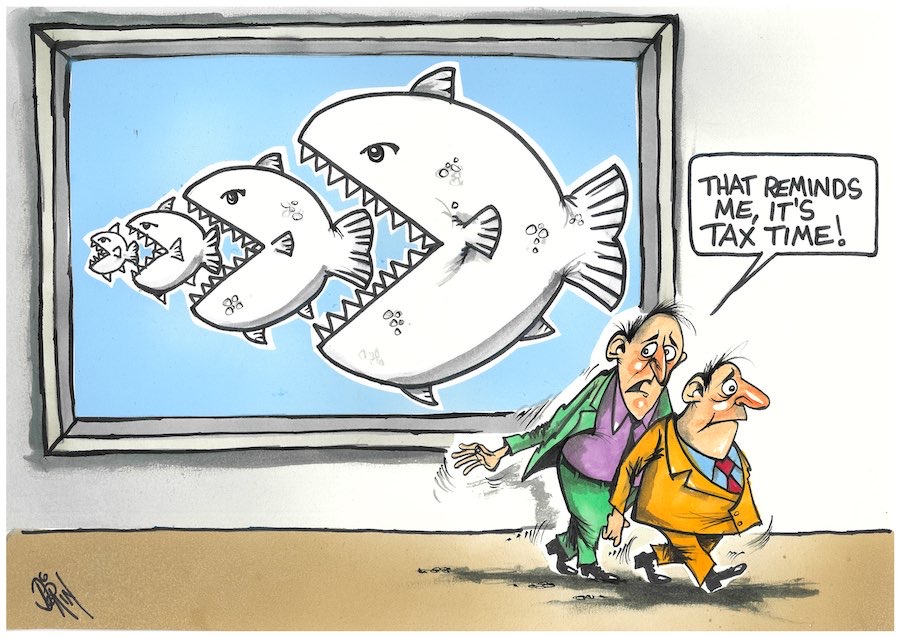

In the run-up to the end of the financial year, it’s time to complete tax returns. Chartered accountant GAIL FREEMAN has some timely advice about work-related deductions.

The Australian Taxation Office (ATO) says one of its areas of interest this year is claims for work-related deductions in 2024 tax returns.

In the run-up to the end of the financial year when many people will be completing tax returns, the following information will help in preparing your records.

As many of us continue to work from home this is a good opportunity to remember your obligations in claiming working-from-home expenses. There are two methods of claiming those expenses – the fixed-rate method and the actual cost method.

The fixed-rate method allows a claim of $0.67 an hour for each hour worked at home and covers electricity and gas used in your home office. It also includes phone costs, data, stationery and computer consumables.

The most important thing in any home office claim is that you need to have a diary record showing your starting time, your finishing time, your lunch break and any other relevant breaks.

An estimate of, say, two hours a night or when I worked all day on Friday so that is 7 1/2 hours which does not satisfy the ATO’s rules. If you keep timesheets they are acceptable to the ATO as a record. In all other cases, starting and finishing times are the criteria for making claims. It is also important that you have an obligation to pay the electricity even if you are not the homeowner.

The actual-cost method requires you to work out the percentage of running costs that you incur in working from home. This needs an apportionment usually of your floor area, but you could use some other appropriate means. The disadvantage of using this method is that claims are messy.

You cannot claim for rates or interest on your loan unless you are carrying on a business from home. It is also worth remembering that if you are carrying on a business from home, whether you claim the costs or not, a proportion of the selling price is subject to capital gains tax when you sell. If you use the actual-cost method you can also claim for your phone and data.

You can claim separately for depreciation on the assets in your home office under both methods. You have to depreciate every item that costs more than $300, so these claims are generally small. In the case of computers you need to apportion the usage. The best way to do this is to keep a log for a representative month of use and the calculated percentage can be applied across the whole year.

The ATO is also looking at car expenses. Again, there are two methods you can use to claim car expenses. The first is cents-per-kilometre. You can claim $0.85 per kilometre for work-related use of your car. If you use this method the rate includes registration, fuel, insurance, repairs and tyres.

Alternatively, you can claim the logbook method, where you have to keep a logbook for 12 weeks, which is a representative sample of your car usage. You also need receipts to claim car expenses. The ATO has reminded taxpayers that a credit card statement is not a valid receipt.

The ATO also says if you have been reimbursed for a cost, you cannot claim it in your tax return – this is known as double dipping. If you are reimbursed for cents per kilometre, this is included on your payment summary so you can claim the offsetting deduction.

If you need any help with your claims and what you can include as tax deductions contact the expert team at Gail Freeman & Co Pty Ltd on 6295 2844, email info@gailfreeman.com.au or visit gailfreeman.com.au

Disclaimer

This column contains general advice, please do not rely on it. If you require specific advice on this topic please contact Gail Freeman or your professional adviser. Authorised Representative of Lifespan Financial Planning Pty Ltd AFS Lic No. 229892.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply