By Jack Gramenz

The growth in Australian home values is slowing but an emerging downturn will not solve dire housing affordability challenges.

The nation’s two most populous cities – Sydney and Melbourne – are driving the fall, with Canberra and Hobart values also declining, while growth continues at a slower rate in other capitals and regions across Australia in analysis from property data firm CoreLogic.

“Even in the highest growth markets like Perth, Brisbane and Adelaide, we’re seeing the pace of growth slow right down,” CoreLogic research head Eliza Owen told AAP.

Sydney and Melbourne have about 40 per cent of the nation’s housing stock, accounting for about half the total value of homes nationwide and largely impacting the change in value.

When seasonally adjusted for the typically slower December period national values grew slightly, but more homes have been hitting the market and taking longer to sell.

Growth has been slowing since June but values have consistently climbed for 21 months, increasing almost 15 per cent in the same period and are unlikely to fall anywhere close to that amount, Ms Owen added.

“Housing market downturns tend to be shorter and less severe … this is unlikely to match the magnitude of the preceding upswing.”

A cyclical downturn will also be unlikely to cure the ongoing housing affordability challenges around the nation, especially for lower-income households and renters.

Signs of a downturn reflect slowing income and economic growth, while a discrepancy remains between what houses cost and what households can pay, Ms Owen said.

“Increasingly, our housing market has reflected people not buying off income and savings alone, but relying on having a higher income, having a really high deposit and getting help from the bank of mum and dad.

“But eventually, even that source of demand gets tapped out, something’s got to give and it looks like that give is finally occurring,” Ms Owen said.

Issues with supply also remain.

Australian Bureau of Statistics data on Tuesday showed dwelling approvals fell, with fewer than 15,000 approved in November, bucking an upward trend.

While the pace is expected to pick up in 2025 and 2026, ongoing competition for labour, increased costs for builders amid high insolvencies and elevated interest rates still pose a challenge.

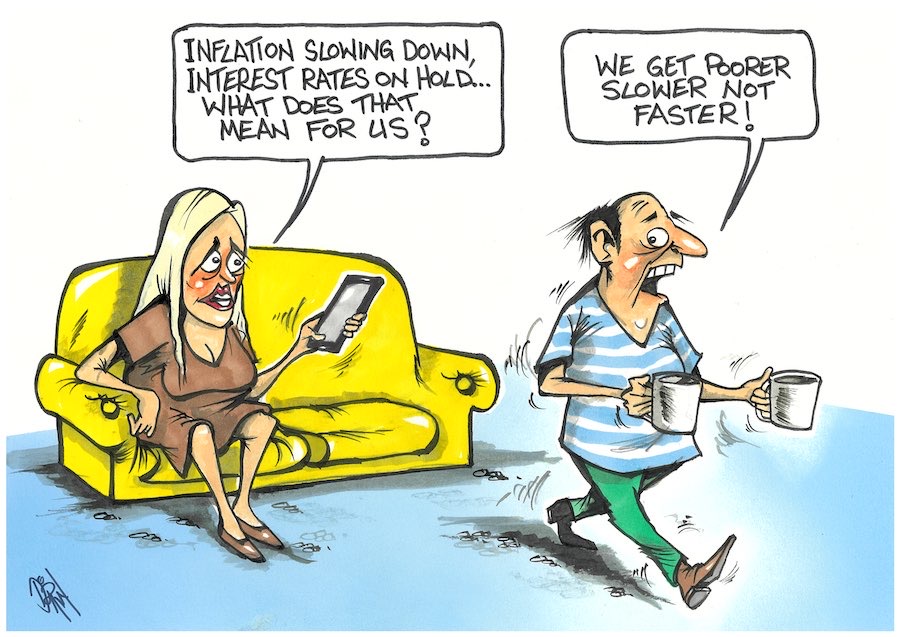

CreditorWatch chief economist Ivan Colhoun said lower inflation and slowing population growth could deliver some interest rate cuts, but not as much as some may hope.

“The emerging upturn in housing approvals without any interest rate reductions is another reason for expecting any interest rate easing cycle… to be relatively limited,” he said.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply