JON STANHOPE and KHALID AHMED reveal that the ACT cannot meet the deadlines on the borrowed billions due to be repaid soon. And the interest bill is mounting…

WE have previously written about the astronomical increase in the ACT’s Net Debt from the territory having a $736 million surplus in 2011 to a debt of $4.4 billion in 2021.

The 2021-22 Budget Review, released in February, forecasts an increase in Net Debt to $9.1 billion by 2024-25.

Information recently released by Treasurer Andrew Barr in response to a question from Opposition Leader Elizabeth Lee about the level and nature of the ACT’s debt is deeply concerning.

Lee’s question sought, in essence, a breakdown of all existing borrowings including the amounts and respective terms at which the money had been borrowed.

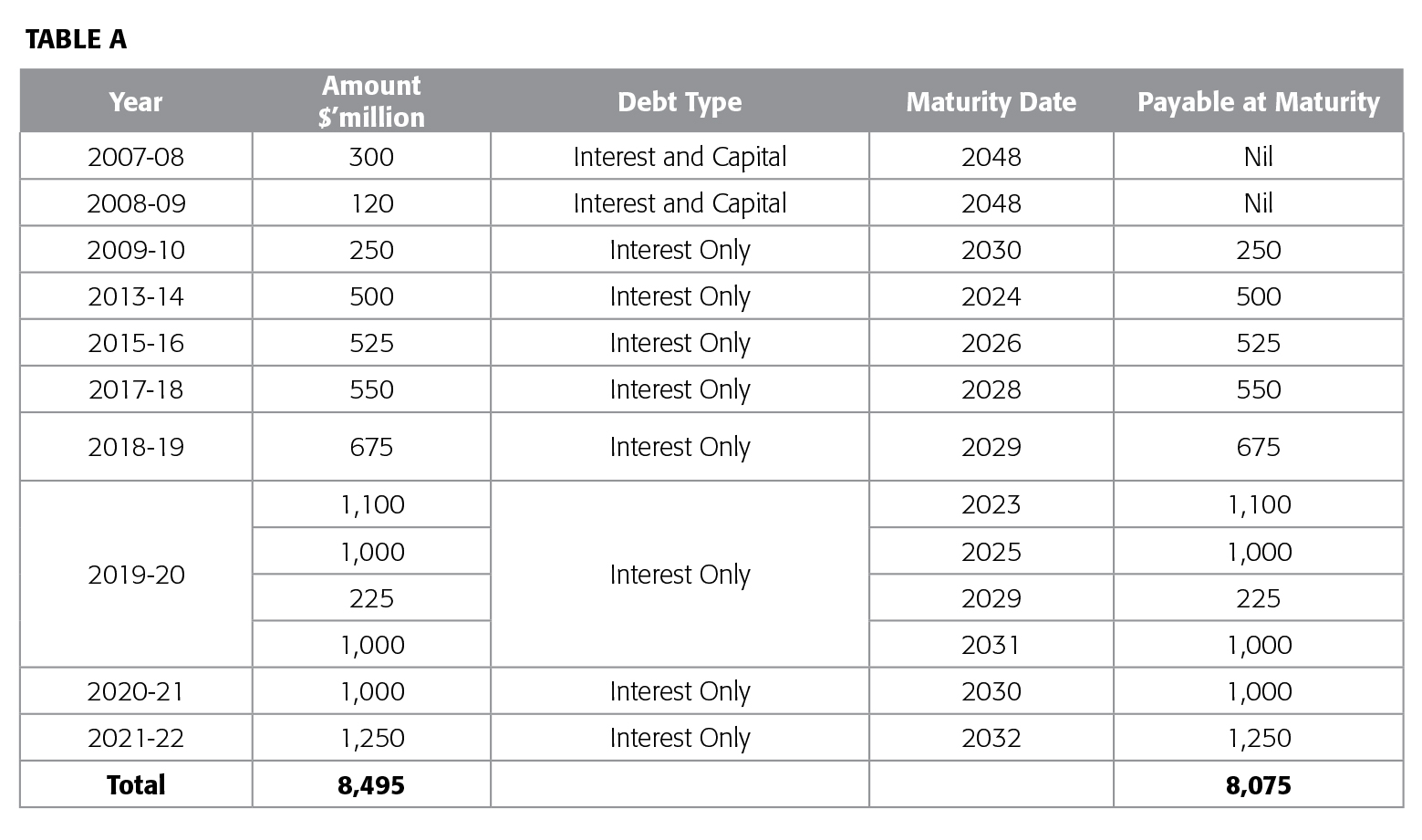

The following table (TABLE A) is compiled from Mr Barr’s response.

We have no comment to make on the interest rate of each of the borrowings but have assumed the government achieved the best (lowest) rate available from the market.

However, the duration of the loans and their terms (ie, whether the repayments are for both interest and capital or interest only), are extremely significant aspects of budget and debt management policy.

In this regard, it is notable, first, that all the debt raised after 2008-09 is on “interest only” terms. What this means is that the full amount of each tranche of the borrowings will need to be repaid in a future budget.

Secondly, over the forward estimates period, which is coincidentally the remainder of this term of the current government, $2.6 billion of debt will mature. In the term of the next ACT government, ie, from 2024 to 2028, $3.225 billion of existing debt will need to be repaid.

It is simply inconceivable, given the state of the ACT budget, that either the current or the next government will be able to repay the amounts due.

These amounts will, without doubt, have to be refinanced as the term of each tranche matures. Indeed, the 2021-22 Budget Review foreshadows new borrowings, over the forward estimates, specifically for the purpose of repaying loans that have matured.

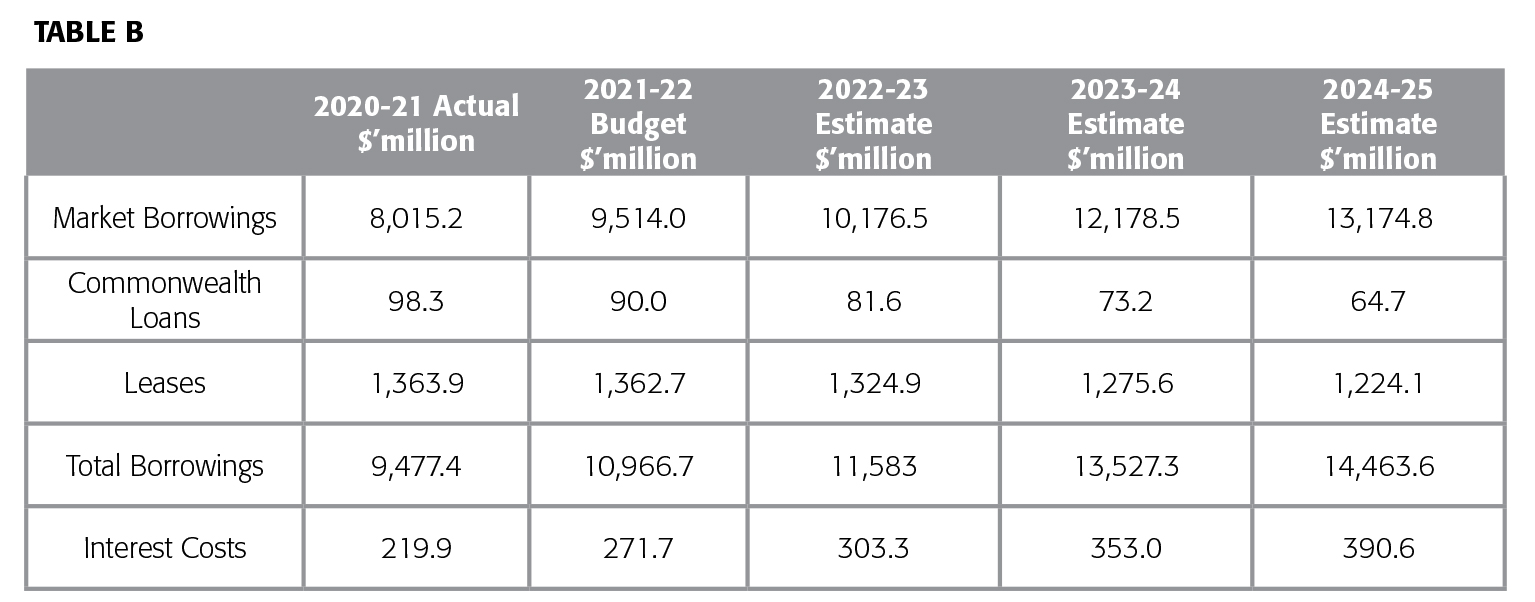

In addition, there was a trend increase in new borrowings before the pandemic in 2019-20 and there are no signs of that trend being arrested. In fact, according to the most recent budget papers (Budget Review, Page 91), it is proposed to increase market borrowings from $8 billion in 2020-21 to $13.2 billion in 2024-25, which is an annual increase of more than 13 per cent at a compounding rate.

Interest costs, on market borrowings alone, more than double from $171 million in 2020-21 to $345 million in 2024-25, in other words more than $2000 per household.

In 2020-21 total interest costs for the territory comprised 3.5 per cent of the operating revenue. In 2024-25, interest costs will be equivalent to 5.5 per cent of operating revenue. This data (TABLE B) is suggestive of a possible debt spiral.

Interestingly, as reflected in the table above, the Commonwealth public housing loan which the chief minister has been vociferously demanding be forgiven, represents a mere one per cent of the territory’s debt. Worryingly, the interest costs in the above table are certain to rise as the maturing loans are, as foreshadowed in the budget papers, refinanced in an environment of rising interest rates.

Canberra residents, busy with their everyday lives, are entitled to expect that matters of debt and budget can be safely left to the government and that they need not concern themselves with such mundane matters.

Indeed, the ACT government has also claimed, repeatedly, that the level of debt relative to the size of the ACT economy is small and manageable, and that neither Mr Barr nor his officials are losing any sleep over our rising debt.

However, for those of us concerned about public financial management, and able to devote time to analysing the related measures of debt sustainability (for example, revenue and expenditure growth rates, net operating balance and primary balance), the level of debt which the current ACT government has incurred and its trends are alarming.

We are also cognisant of the importance of not confusing or comparing the debt sustainability metrics at the Commonwealth or national (sovereign) level with those at a state/territory level.

The ratio of debt to economic output (as measured by GDP) is a commonly used and appropriate measure at the national level.

At the state/territory level, especially for the ACT, this measure has major limitations and is misleading. This is because in Australia, states and territories do not have recourse to taxing output and, as such, their tax revenues do not have automatic buoyancy from growth in economic output.

State and territory revenue raising is largely limited to, apart from cost recovery from user charges and fines, taxing land and transactions, the latter of which is set to be abolished by the ACT.

The second major difference is that unlike the national government, states and territories do not have recourse to money supply from the central bank, ie, monetising deficits that may indeed be appropriate under certain specific circumstances.

The appropriate measure of debt sustainability for states and territories is the debt to revenue ratio, which is the measure that the rating agencies use in assessing the credit worthiness of subnational governments.

On this measure, in the ACT, the net debt to revenue ratio increases from 69 per cent in 2020-21 to 127 per cent in 2024-25. The gross debt to revenue ratios are 150 per cent and 202 per cent respectively.

If this trend continues, a rating downgrade would seem to us to be unavoidable.

Of greater concern is whether a point will be reached, if we continue on the current trajectory and with the same fiscal strategy, that we suffer a debt spiral and, heaven forbid, insolvency seriously threatens.

We the residents of Canberra do also need to stop and reflect on the implications for future generations of the increasing burden of debt that we are bequeathing to them.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply