“The government is in a bind. If it meets its revenue estimates, it will have been at a significant impost on households. If it falls short, its claims of budget recovery cannot be met.” JON STANHOPE & KHALID AHMED despair at the community effects of the ACT government’s budget tax grab.

The ACT’s 2024-25 budget is underpinned by a forecast of an extraordinary growth in revenue.

In our initial commentary we pointed out that this was not good news for Canberrans on low-to-moderate incomes already suffering under extreme cost-of-living pressure.

As a rule, budgets are developed with clear regard to the prevailing social and economic circumstances. Governments with a progressive policy agenda, are typically mindful of the impact of the budget on disadvantaged and marginalised groups.

In the Australian federation, state and territory governments are unable to tax incomes, production or consumption, which remain within the purview of the Commonwealth government. Therefore, state and territory governments rely on taxing transactions, employers’ payrolls, mining, gambling and, to varying degrees, land.

The ACT is notably disadvantaged by the absence of mining and large-scale manufacturing bases and by the ACT government’s commitment to eliminate transaction taxes as part of its taxation reform.

It goes without saying that governments must be mindful of the ability of individuals and entities to pay when raising revenue, and the needs of individual services when allocating expenditure.

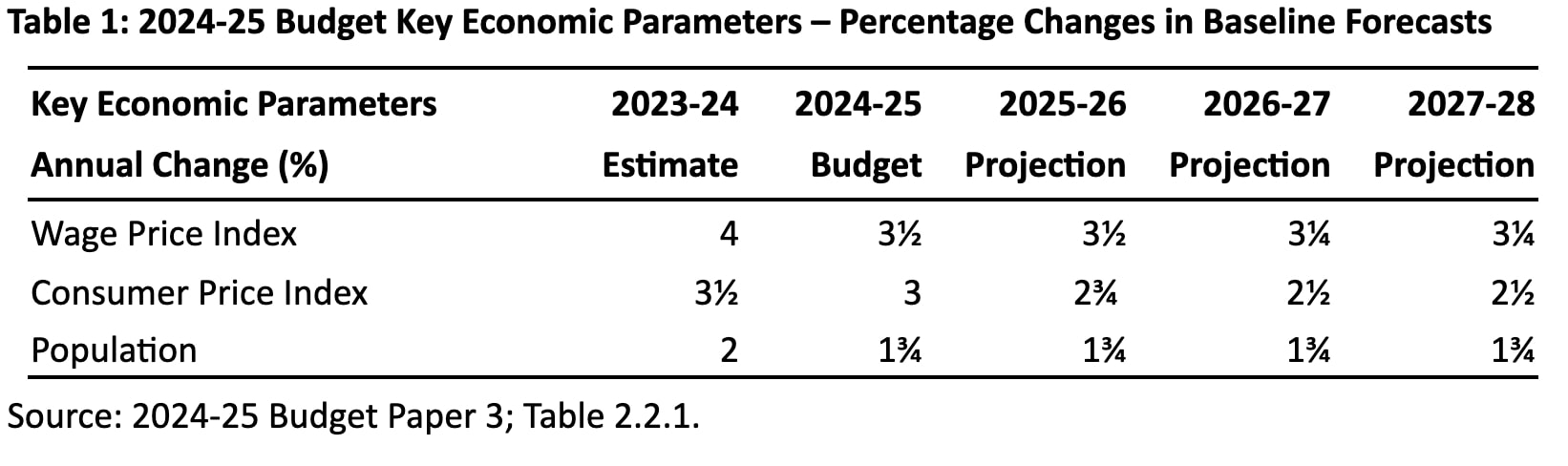

Therefore, economic parameters driving the budget are changes in the Wage Price Index (WPI), the Consumer Price Index (CPI) and population growth.

Revenue growth above the WPI is likely to put pressures on households, particularly those already under financial stress due to increases in interest rates and inflation (CPI).

On the expenditure side, the costs of service delivery will be driven by a combination of WPI and CPI, and population growth. For quick reference, Table 1 provides the ACT government’s forecasts of percentage changes in these key economic parameters.

It is notable that wages are forecast to rise by 3.5 per cent in 2024-25 and 2025-26, before decreasing to 3.25 per cent over the final two forward years.

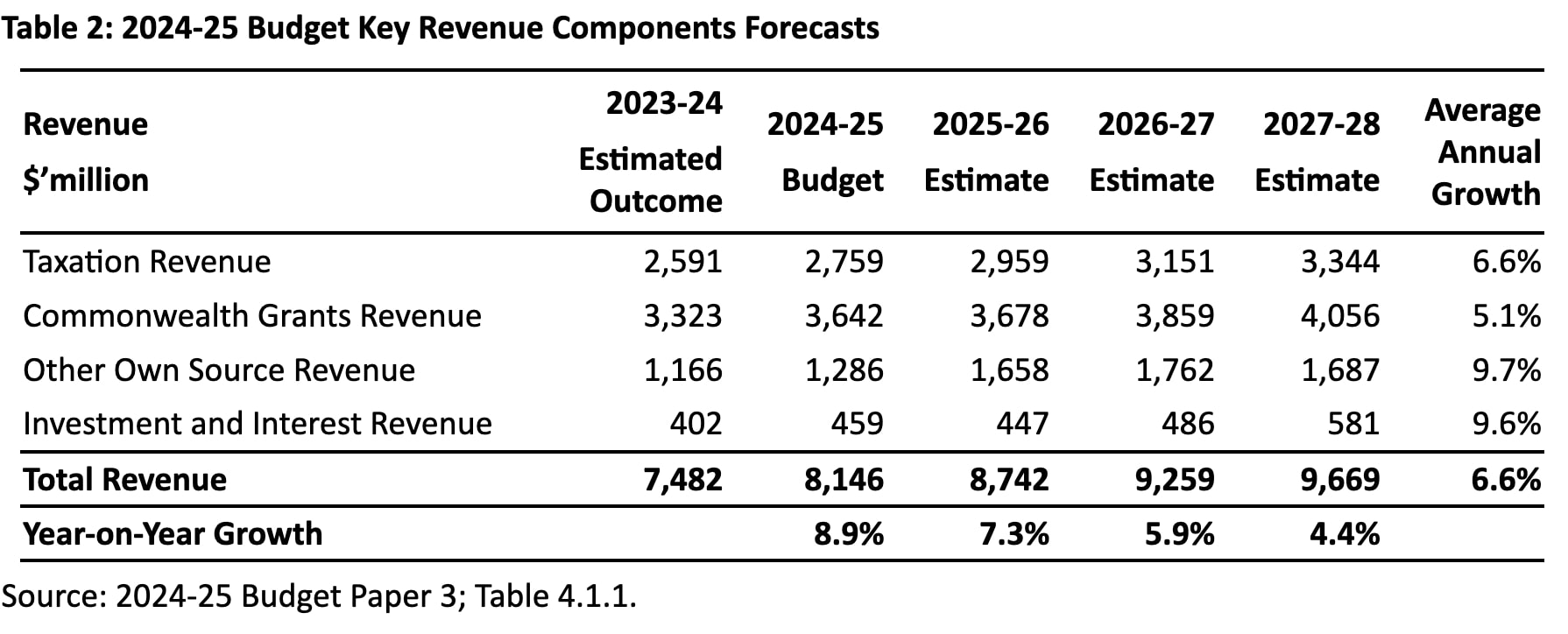

In Table 2 we break down revenue into four categories: taxation; other own-source revenue; Commonwealth grants and returns on investments. The first two, namely taxation and own-source revenue, broadly reflect the weight of revenue raising, directly or indirectly, on households and businesses. Together they comprise 50 per cent of total revenue in 2024-25 increasing to 53 per cent in 2025-26.

The table also incorporates the Compounding Average Annual Growth Rate (CAGR) of each component as well as year-year growth in total revenue.

In 2024-25 total revenue is forecast to grow by 8.9 per cent over and above the 2023-24 estimate.

The ACT government cannot hold the federal government responsible for its budgetary woes and aggressive revenue raising.

Commonwealth grants increase at a healthy rate of 5.1 per cent a year, driven by both an increase in the relativity from population growth revealed in the 2021 Census, and the increase in mining revenue raising capacity in coal-producing states. Notably, royalty revenue from coal almost doubled from $10.9 billion in 2021-22 to $20.2 billion in 2022-23, a share of which the ACT received through the GST distribution.

In 2024-25, in the face of an anticipated wage rise of 3.5 per cent, the budget nevertheless forecasts an increase in taxation of 6.5 per cent. This “excess” taxation growth continues across the four years of the forward estimates with a budgeted CAGR of 6.6 per cent.

Payroll tax is the standout target of the ACT government’s quest for revenue. It is budgeted to grow from an estimated $751 million in 2023-24 to $1.118 billion in 2027-28, at an average rate of 10.5 per cent annually. Utilities (Network Facilities Tax) will grow at 5.3 per cent per annum. These large increases will, of course, inevitably, be passed straight on to consumers – i.e you.

General rates are to increase at a compounding annual rate of 6.5 per cent. Duty on conveyances is forecast to deliver $302.1 million in 2024-25, increasing marginally to $302.8 million in 2027-28. Notably, this is more than the government was collecting when its now infamous tax reform agenda began.

Canberrans are surely more than entitled to demand of the Treasurer, Andrew Barr, an explanation, of how it is that rates are increasing at a compounding rate of 6.5 per cent despite the explicit promise made by him a decade ago, that as a quid pro quo stamp duty would be abolished.

Another prime example of the government’s doublespeak is reflected in its toying with the Police, Fire and Emergency Services Levy. The levy is estimated to deliver $105.2 million in 2023-24 but has been forecast by Mr Barr to grow at an astounding rate of 9 per cent a year over the budget and forward-estimates period.

Apart from stock growth, which is a relatively smaller contributor to growth, the growth in levy is from escalation at 4.3 percentage points above the wage price index.

If this sounds arbitrary, it is. It is deeply worrying and we feel genuinely sorry for those employed within the ACT government, most particularly the Treasury, who as true professionals spend their working lives seeking to implement principle-based financial management, but are forced to defend this tosh.

The rationale the government has provided for the above WPI (and arbitrary) increase in the levy on households is that “these increases reflect increasing ACT Policing expenditure as per the ACT government service agreement with the Australian Federal Police and increased police numbers.” (Budget Paper 3; Page 211).

This levy, originally called the Fire and Emergency Service Levy, replaced a tax on insurance policies, which only partly funded fire brigade services.

However, the Greens-Labor Coalition in the ACT has expanded the scope of this levy to include policing costs, a change that went unremarked by a compliant mainstream media.

In principle, policing costs should surely be funded from central revenue. The imposition of a levy to fund the cost of policing, and then increasing the levy to match the increase in service costs opens the door to a very slippery slope. What is to say that the government could not introduce (say) a transport levy, or a school levy or a hospital levy?

The government is in a bind in this budget. If its revenue estimates are achieved, it will have been at a significant impost on households. If its revenue estimates are not met, its claims of budget recovery cannot be met.

As we noted in a previous article the budget provides for an annual increase in expenditure of 3.4 per cent. That is clearly not sufficient to maintain current levels of service.

Having regard to the data in relation to population and wages growth and inflation incorporated in Table 1, we estimate that growth in expenditure in excess of 5 per cent will be required in order to meet existing services, let alone address the myriad gaps in service delivery being experienced by the working class the poor and the elderly.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply