“Stunningly, per capita taxation in the ACT has increased by 24 per cent in just the last two years… it’s difficult to justify the ACT’s excess taxation when debt’s rising, the hospital system is the country’s poorest and services for disadvantaged groups are the nation’s worst,” write JON STANHOPE & KHALID AHMED.

Along with the national media, we have reported that the ACT is the highest taxing jurisdiction in Australia.

Chief Minister and Treasurer Andrew Barr, in recent Public Accounts Committee hearings, challenged this assessment, arguing that the ACT’s rate of taxation as reported by the Australian Bureau of Statistics (ABS), includes local government taxes and, as such, could not reasonably be compared with the States.

In fact, Mr Barr insisted that a comparison of state and local government taxation (also published by the ABS), reveals that the ACT’s per capita taxation is lower than both NSW and Victoria – that is, the third highest but not the highest.

Any discussion of taxation rates is, of course, relative. It could, for example, be argued it is relative to a person’s capacity to pay, or the availability, capacity and nature of individual tax bases.

It may be, for instance, that a jurisdiction may not have access to a particular tax base, say in the case of the ACT, a mining industry. It could also be relative to the economic and social impact of the taxes that are imposed, eg land tax.

Invariably, most discussion about tax is focused on the return or benefit it delivers to the community. In this regard a majority of people would be willing and, in fact, happy to pay an extra, say, $500 a household if that money delivers better schools or additional hospital beds or more doctors, nurses, police or firefighters. However, if that $500 is wasted on a failed IT project, that “willingness” will quickly dissipate.

We had assumed that Mr Barr would have been fully briefed on the ACT’s relative taxation and where it stands. We hoped, therefore, that rather than squabbling about the taxation level, that he would respond to media commentary by explaining the benefits accruing from our nation-high taxation and assuring Canberrans that their hard-earned money is being put to the best possible uses.

High taxation, of itself, is not a problem. The question is whether those being taxed regard it as a value-for-money proposition. While that is an individual judgment, the following information may assist with that calculus.

Contrary to claims by Mr Barr, the ABS data that compares state and territory taxation is both relevant and appropriate, providing, as it does, information on taxes collected from the bases that are within each jurisdiction’s control.

Those bases may vary in capacity, and indeed in some jurisdictions, may not exist. For example, the ACT has no mining activity at all, and Victoria has negligible mining activity compared to WA and the NT. Conversely, the ACT has access to a base that allows it to tax owner-occupied dwellings, something that no other state enjoys.

It would, of course, be nonsensical for the treasurers in say WA and the NT to argue that taxation comparisons should exclude their mining bases, and similarly as nonsensical to argue that the ACT’s rates base should be excluded from the comparison, especially when the ACT has been transferring its state-level taxes (conveyance duty and insurance taxes) to General Rates. The “jurisdictional control”, therefore, should be the deciding factor when making comparisons.

The relevant ABS data provides the nominal amount of tax revenue collected. On those measures (whether state only or state and local combined), the ACT’s taxation should be below the national average because the ACT has below-average taxing capacity and it is compensated for that shortfall – being below NSW and Victoria is hardly a relevant benchmark.

Indeed, in 2012-13, the ACT was a below-average taxing jurisdiction on Mr Barr’s preferred measure ($3228 per capita compared to the national average of $3356 per capita). However, with the highest taxation growth rate in Australia over the following decade, the ACT crossed the average in 2026-17, and in 2021-22, per capita taxation in the ACT was $5346 compared to the national average of $5171.

However, what is most relevant is how much each jurisdiction is collecting (a) relative to the capacity of its tax base; and (b) relative to other jurisdictions. The former provides an indication of the tax burden on each jurisdiction’s economy, and the latter its competitiveness with respect to other jurisdictions.

In previous articles, we detailed the Commonwealth Grants Commission’s methodology for distributing GST revenue, which involves an assessment of each jurisdiction’s taxing capacity for each of the tax base. Any jurisdiction with lower-than-average capacity is compensated through the GST distribution.

States and territories are free to set their own policies and may tax higher or lower than their assessed capacity. The ratio of actual taxation to the assessed capacity would, by definition, be its taxation effort relative to capacity.

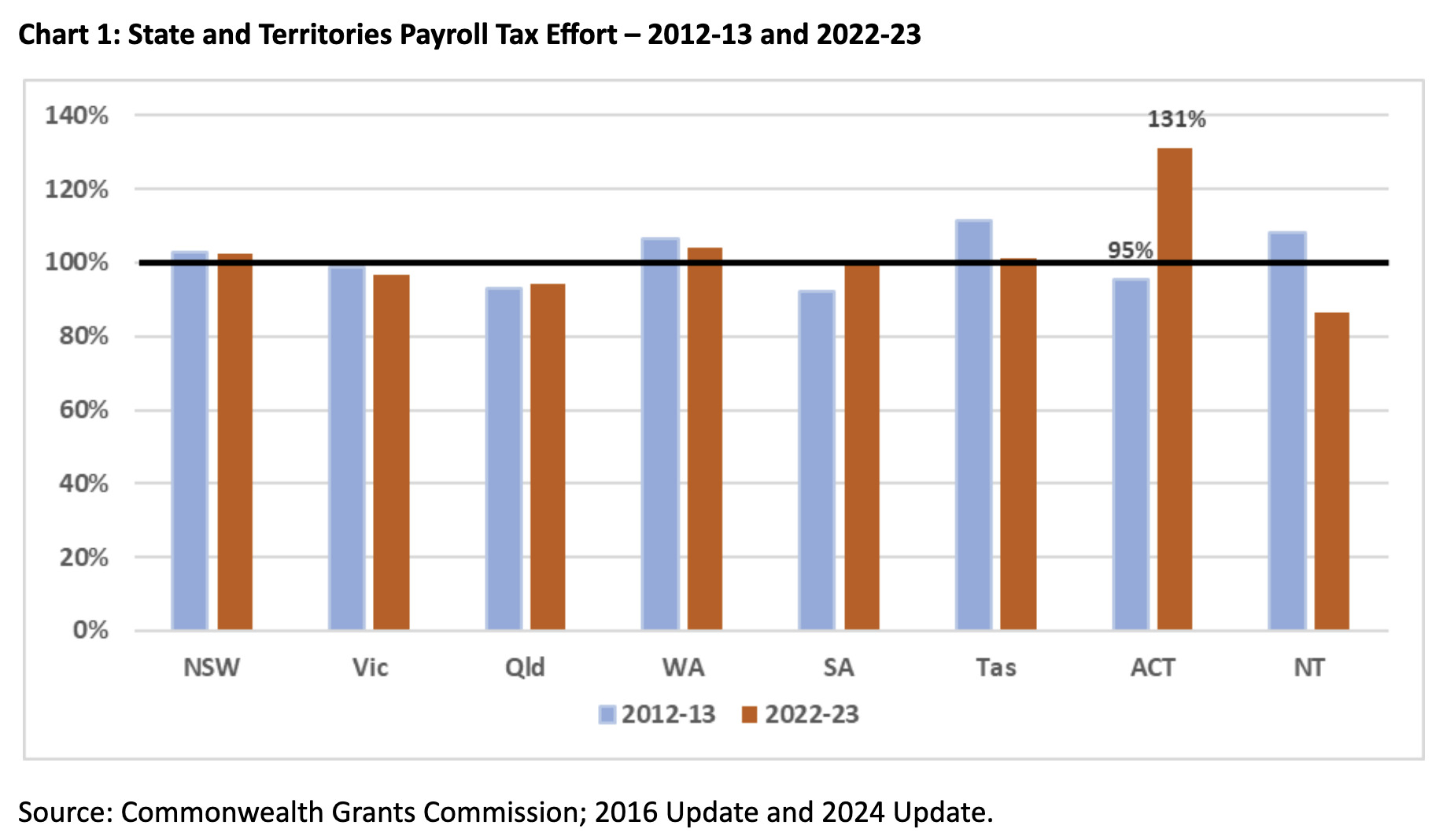

For simplicity’s sake the following comparisons relate only to key state level taxes. Chart 1 details the taxation effort of states and territories for payroll tax – a state-only tax.

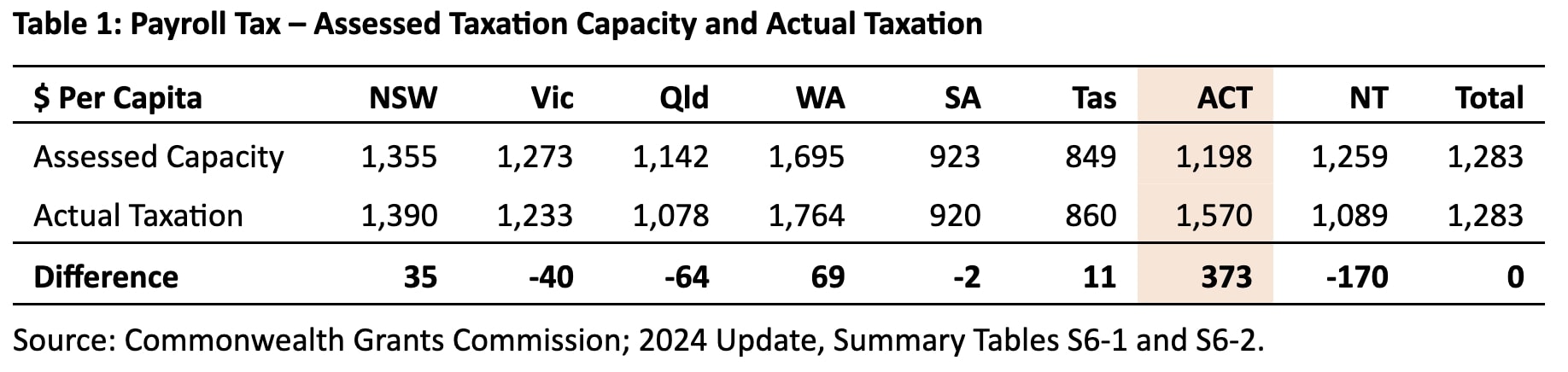

By definition 100 per cent is the average taxation effort. In 2012-13, the ACT was a below-average taxing jurisdiction relative to its capacity. However, in 2022-23, the ACT became the highest taxing jurisdiction relative to its capacity. Table 1 provides the per capita payroll tax capacity and actual taxation across all jurisdictions in 2022-23.

By definition 100 per cent is the average taxation effort. In 2012-13, the ACT was a below-average taxing jurisdiction relative to its capacity. However, in 2022-23, the ACT became the highest taxing jurisdiction relative to its capacity. Table 1 provides the per capita payroll tax capacity and actual taxation across all jurisdictions in 2022-23.

If the ACT had adopted an average taxation policy, it would have collected $1198 per capita, compared to the national average of $1283 per capita. The ACT actually collected $1570 per capita, ie an extra $373 per capita (or $172 million). A clear case of “double dipping”, or “fingers in the till” where the territory received compensation for its lower assessed level of payroll capacity, but nevertheless taxed much more.

The economic incidence of payroll tax is on employment or the price of goods and services, depending upon the circumstances. With the ACT’s rate of unemployment being relatively low, then the super high level of payroll tax imposed on Canberrans impacts most directly on household costs, ie the cost of living.

The discussion on cost-of-living pressures has focused, in the main, on inflation, supply chain problems and geopolitical conflicts. The ACT government’s taxation policy is another significant factor.

Stunningly, per capita taxation in the ACT has increased from $1270 in 2020-21 to $1570 in 2022-23, an increase of 24 per cent in just the last two years.

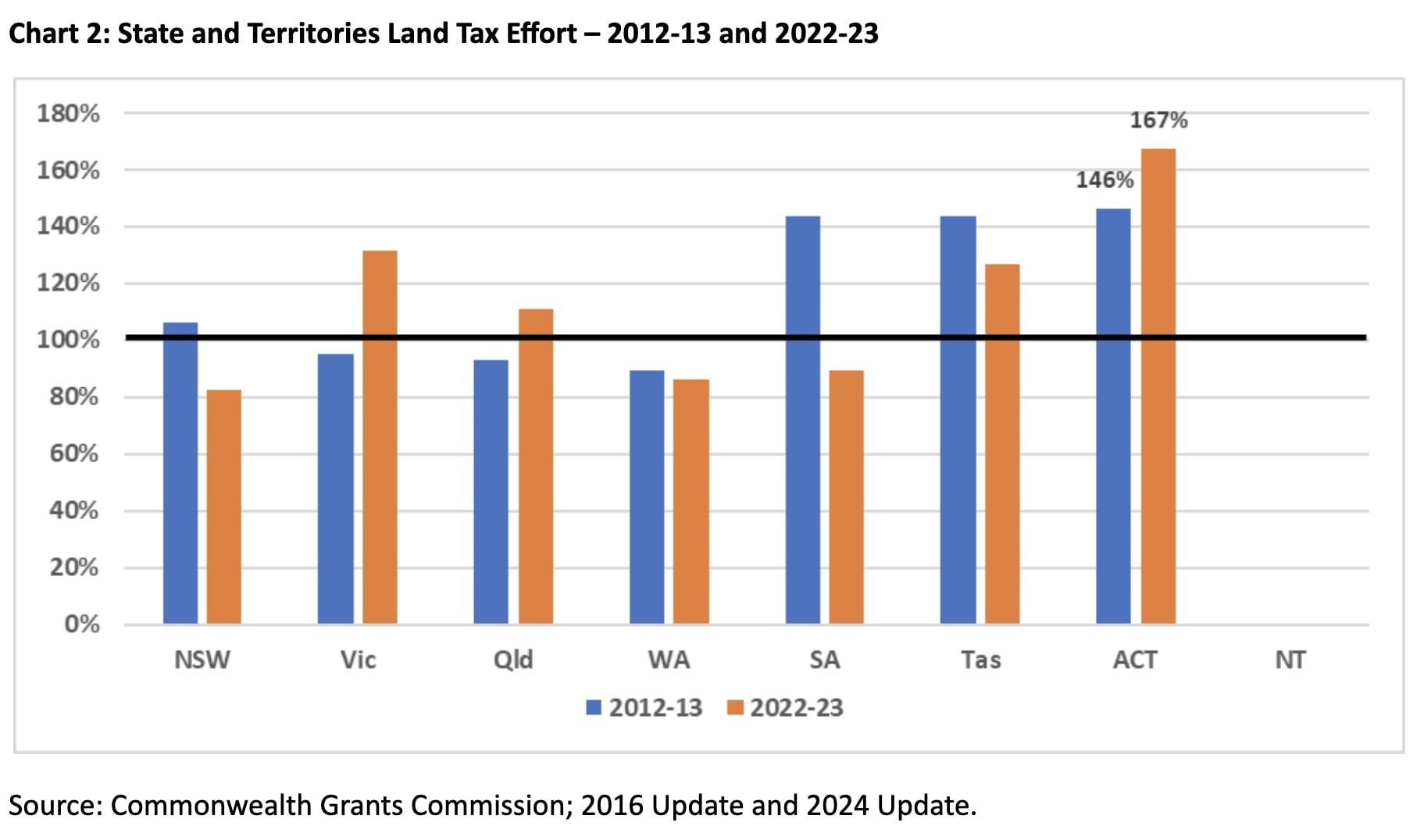

The ACT’s land taxation effort is relatively higher than its assessed capacity. Notably, the government announced over a decade ago it intended to abolish the tax following the 2012 ACT Taxation Review. However, over that decade, land tax effort has in fact increased primarily because of misinformed and regressive policies pursued by the Greens, and readily adopted by ACT Labor.

The economic incidence of land tax is on returns to investors (in turn on supply) or rents depending upon the conditions in the market. The ACT’s high rents can be directly attributable to the government’s taxation policy and the deliberately inadequate supply of land for housing.

Is the ACT the highest taxing jurisdiction in Australia? Yes – by a country mile – looking at the comparative data on payroll tax and land tax. We will discuss the remaining state-based taxes, duty on conveyances, insurance taxes, motor taxes and mining tax in a later article. However, the picture is not likely to be any better.

Does higher taxation provide value for money?

While that is a judgement for the community to make, we note that it is difficult to justify this excess taxation when the operating budget is the weakest of all jurisdictions, debt and interest costs are rising exponentially, the hospital system is the poorest performing in the country due to withdrawal of funding and service outcomes for disadvantaged groups are the worst in the country.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply