“If the government is not willing to adjust land prices downwards, the budget forecasts of land supply are little more than wishful thinking.” JON STANHOPE & KHALID AHMED say revenue estimates for land supply make no sense.

If there are barriers to entry to the housing market, or if it becomes unaffordable, there will be a greater need for social housing.

It falls to governments to ensure the market is operating as efficiently as possible.

Of fundamental importance is a land-supply system that delivers land suitable for a range of housing options at affordable prices and which is responsive to demand.

For example, it may be the case that, prima facie, there are sufficient developments to meet unmet demand, but the developer (in this case the ACT government) is deliberately drip feeding the market to drive up land prices.

In other words, supply is being constrained even though dwelling sites are available to be released and any suggestion by members of the ACT government that house prices are not dependent on supply should be ignored.

We were encouraged by the announcement, in the 2024-25 Budget, that the government intended to increase land supply. Regrettably, on a closer reading, it transpires that the commitment is not supported by either the financial estimates or the reality of the supply system.

The 2024-25 Indicative Land Release Program (ILRP) sets a target of 5107 dwelling sites for 2024-25.

While the estimate of land supply achieved in 2023-24 is not available in the Budget Papers, the 2023-24 ILRP set a meagre target of 1883 dwelling sites. We assume that this risibly low target was achieved.

However, the 2024-25 target is more than 170 per cent higher than the 2023-24 target. While this increase is commendable, we have no expectation, based on this government’s record, that it will be achieved or sustained.

The last time land supply in the ACT exceeded 5000 dwelling sites was in 2010-11. Not once since then has the government gone anywhere near achieving that level of supply.

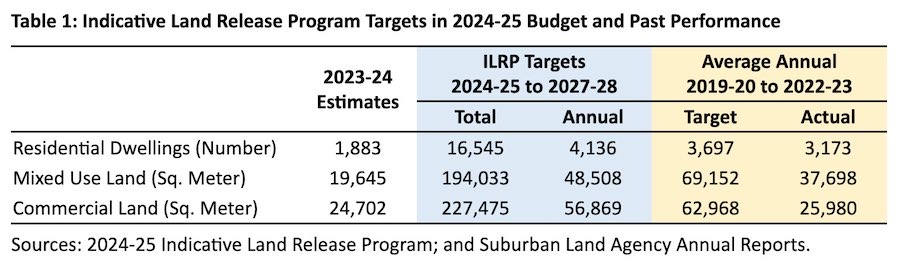

Table 1 includes the supply targets for dwelling sites as well as mixed-use and commercial land over the budget and forward estimates. For comparative purposes, we have included in Table 1 the target and actual average annual supply for these categories over the four-year period from 2019-20 to 2022-23.

The 2024-25 Budget sets an annual average target of 4136 dwelling sites in each of the next four years. This represents an increase of 30 per cent above the 3173 sites a year delivered over the past four years. Similarly, the annualised target for mixed use land is increased by 29 per cent (from the actual average of 37,698 m2 to 48,508 m2).

In addition, the budget foreshadows an increase of 119 per cent in the amount of commercial land (25,980 m2 to 56,869 m2) to be released in the next four years. Needless to say, the proposed increases are far greater than the 2023-24 estimates.

This begs the question of how one gauges the adequacy of the mooted increase in land supply?

The answer depends on whether we measure it against actual delivery in the recent past, over a longer time frame, or against underlying demand.

For example, the four-year target of land for 16,545 dwellings is substantially lower than the four-year targets in the 2011-12 and 2012-13 Budgets, of 18,500 and 19,500 dwellings, respectively. In 2010-11, when the Canberra population was 368,000 the government released 5,048 dwelling sites.

Again we ask, will the average of 4136 dwelling sites, which the ACT government proposes to release over the next four years, be enough to meet demand, noting that, in the interim, Canberra’s population has increased by more than 100,000? The answer is clearly, no.

Will the Government be able to sell 4136 dwelling sites annually, on average, over the next four years? The answer to this question critically depends on two factors: (a) the ability of the land supply system to deliver well above what it has been delivering, and (b) the price the government sets for land. Unfortunately, the past performance as well as the financial information, comments and notes (in fine print) in the Budget Papers suggest otherwise.

It is clear, from Table 1 that the ACT government’s land-supply system has fallen short of the targets quite significantly. Notably, the targets in the recent past for mixed-use and commercial land were even higher than the 2024-25 ILRP targets, but the shortfall averaged 45 per cent and 59 per cent respectively.

The preparedness of the supply system is in fact revealed in a strategic indicator in the Environment, Planning and Sustainable Development Directorate’s Budget Statement. The indicator Proportion of sites identified in the Indicative Land Release Program with completed investigation studies has a target of 80 per cent.

One would expect that if the ILRP has any chance of being delivered, all of the sites identified in it have at least the necessary studies completed.

In relation to price, while the ACT government may pretend it’s a passive player in the market, and is selling land at market price, the reality is different.

It is a monopoly supplier, and its policy has been extractive, achieving

supernormal profits. If that policy is maintained, it can be guaranteed that the supply targets and revenue forecasts will not be achieved.

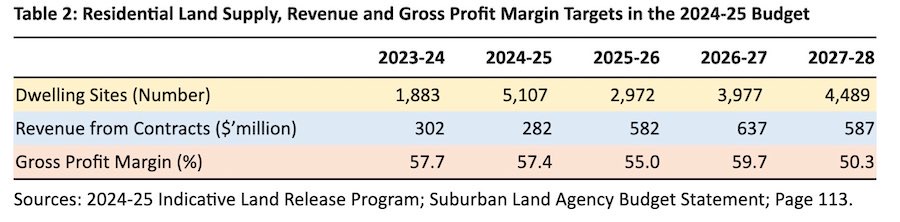

Table 2 provides the dwelling sites in the ILRP, and revenue and gross profit margin forecasts in the Suburban Land Agency’s Budget Statements.

This table is drawn from the SLA’s Budget Statement (Table 4: Key Performance Indicators – Financial Measures). For reference, we have included residential land supply targets from the ILRP, which, surprisingly, are not included in the SLA’s statement.

The target of 5107 dwellings for 2024-25 is, as we noted, unlikely to be achieved, especially if the gross profit margin is to be maintained at the approximate 2023-24 estimated level of 57 per cent. Note 1 in the SLA’s Budget Statement referred to above advises that “the decrease in the budgeted revenue from contracts with customers in 2024-25 is due to a decrease in expected land sales”.

Further, the target for the following year, that is the 2025-26 financial year, drops to 2972 dwelling sites. To put this in perspective, this is below the annual average of 3568 in the years 2011-12 to 2022-23 and, bizarrely, even lower than the previous four years’ average of 3173.

Despite this, the revenue from sales is forecast to more than double to $582 million. In 2026-27, revenue is forecast to increase even further along with an increase in the profit margin to almost 60 per cent. Notably, gross profit averaged 31 per cent in the period 2008-09 to 2010-11, ie about half that currently forecast, despite 4555 sites, on average, being sold at that time.

The market clearing price, that is what customers are willing to pay for this volume of land, is likely to be lower than prices in the recent past.

This is due to broad economic conditions and the outlook on interest rates. A further reason, structural rather than cyclical, is the potential capitalisation of increased taxes (general rates, land tax and land-based levies) into the capital values.

The former cyclical factors are recognised, albeit, as a risk to revenue, in the Statement of Risks in Budget Paper 3, while the latter appear to receive no consideration.

Put simply, the above revenue estimates make no sense, and if the government is not willing to adjust land prices downwards, the budget forecasts of land supply and associated revenue estimates are little more than wishful thinking.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply