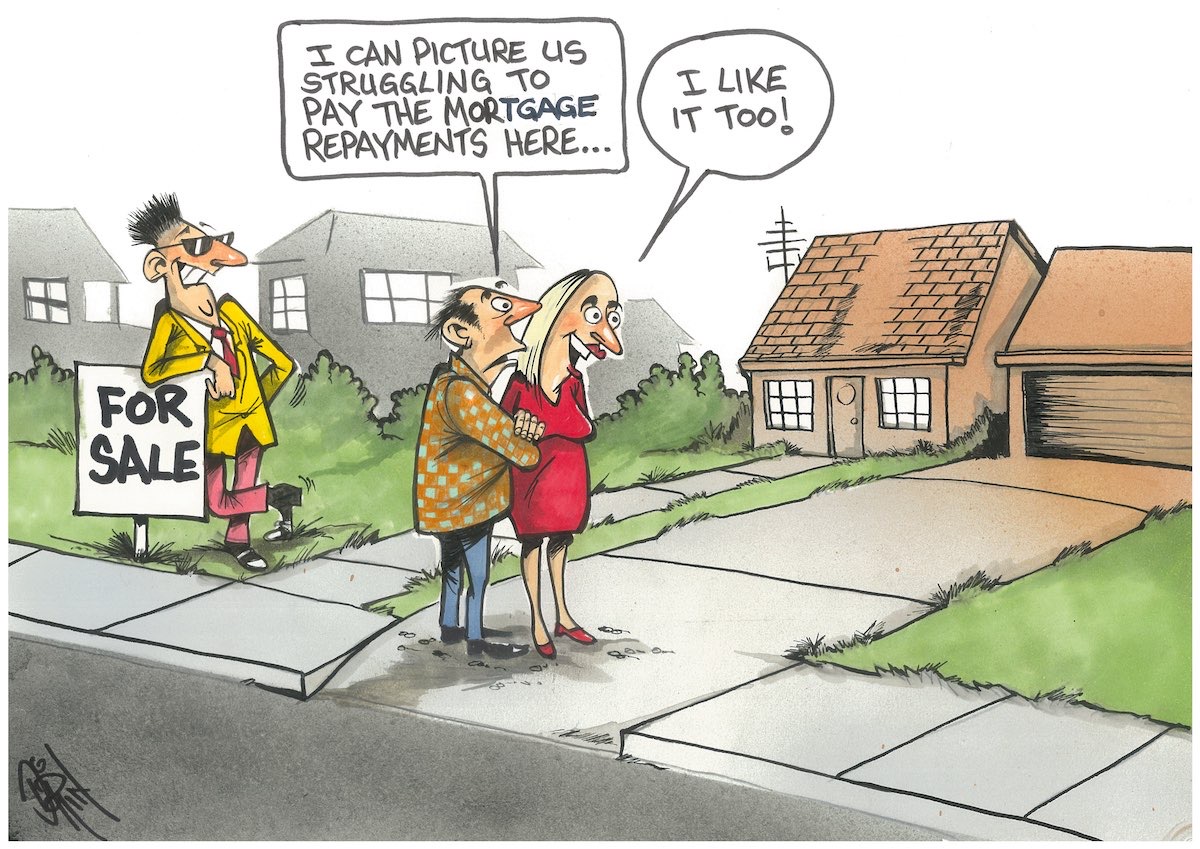

INTEREST rates have increased for the ninth consecutive time with the Reserve Bank this afternoon (February 7) increasing the cash rate by 25 basis points to 3.35 per cent as the bank battles Australia’s runaway inflation.

The latest rate hike means that Canberrans will need a minimum $187,000 in annual household income to afford a house (assuming a 6.22 per cent interest rate and mean average price of $952,000) and $114,000 to afford a unit (priced at $580,000).

Graham Cooke, head of consumer research at comparison website Finder, said the average mortgage holder will be paying more than $12,000 more a year in interest compared to this time last year.

“Australians with the average loan size of around $600,000 will be paying $1000 more per month compared to what they were paying in April last year,” he said.

“That’s a significant amount of extra money to allocate towards your mortgage every month – especially when household budgets are already stretched thin.”

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply