JON STANHOPE and KHALID AHMED break down the ACT government’s economic arguments in support of the tram and reveal how they proved to be disastrously wrong.

AMID the “needs analysis” in the business case for stage one of light rail is a list of the ACT’s economic woes that would be addressed by the project.

Notably, the business case was prepared well after the political and policy commitments to the project had already been made.

Identified in the sub-section “Evidence of the Problem” were the “challenges” facing the ACT economy:

- Below-trend growth in the national economy, with real GDP estimated to grow by 2.5 per cent in 2014-15 and with unemployment forecast at 6.25 per cent in 2014-15;

- 16,500 federal government public service job losses leading to an easing jobs growth rate and increasing overall unemployment in the ACT;

- The impact of the federal government’s 2014-15 budget. According to the ACT 2014-15 budget papers “[m]assive cuts in general Commonwealth Government spending, and in payments to the ACT, will cause job losses and challenging economic circumstances for us”; and

- Forecast decreasing levels of commercial and residential construction.

“ACT government is projecting economic growth in the ACT to grow by 1.75 per cent next financial year. This represents growth below the forecast national average,” the analysis says.

It is generally accepted that long-term projects should seek to address long-term structural problems.

However, it is surely drawing a very long bow to expect that below-trend growth in the national economy, federal government public service job losses and cuts in Commonwealth spending could or would be ameliorated by construction of a 12-kilometre tram line.

The Commonwealth Government job cuts, which some readers may recall were presented as a crisis, were in any event short lived.

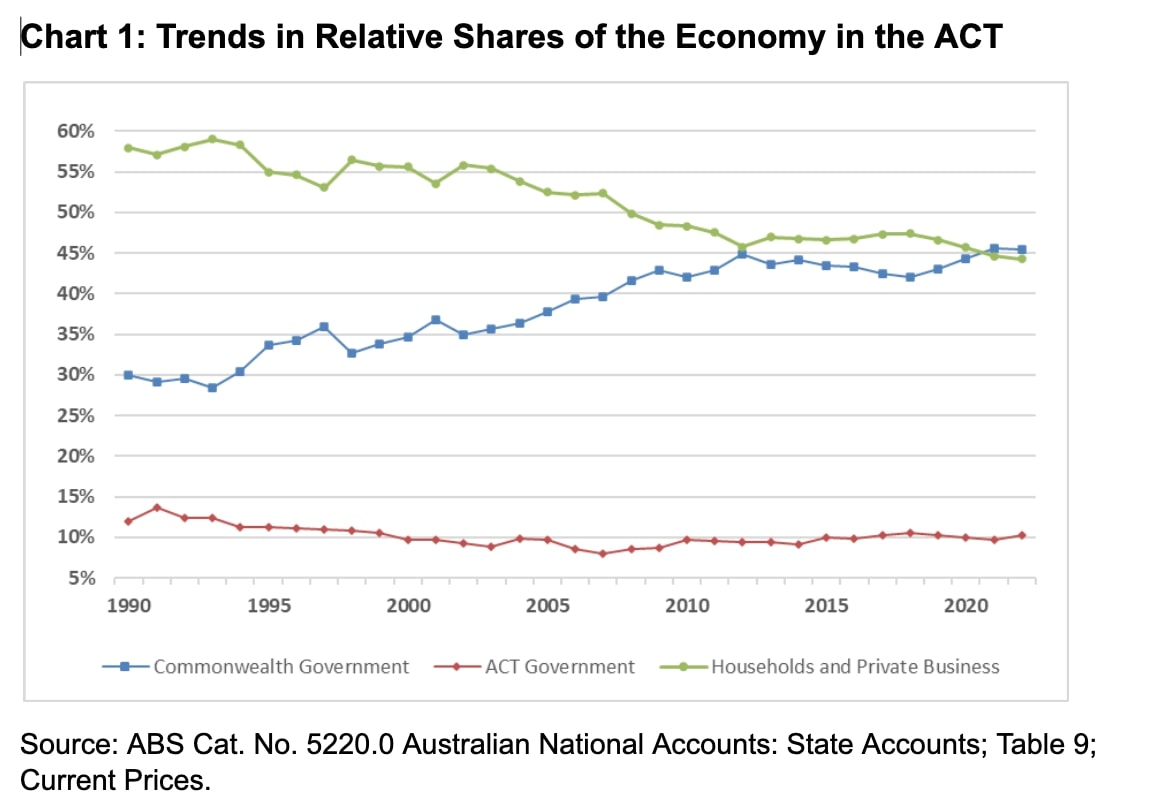

In fact, the Commonwealth Government’s share of the economy, as measured by State Final Demand, has increased over time.

In 2015-16, its share including its consumption and investment, comprised 43.3 per cent of the ACT’s economy.

This share remained flat (although Commonwealth expenditure increased) until 2019. In 2022, the Commonwealth’s share of the economy had increased to 45.4 per cent.

Similarly, the ACT government’s share increased from 9.9 per cent in 2016 to 10.3 per cent in 2022. The private sector’s share comprising household consumption, dwelling investment and investment by private business (in commercial construction and machinery and equipment) decreased commensurately, from 46.8 per cent in 2016 to 44.3 per cent in 2022.

The increase in the Commonwealth Government’s share of the economy, while obviously ameliorating concerns about cuts and job losses on the one hand, exacerbated the “problem” of diversification or the reliance of the ACT economy on government.

With Canberra being the seat of national government, the ACT’s economy, unlike other jurisdictions, receives a significant boost from federal government activities.

Successive territory governments have sought to diversify the ACT economy and to decrease its reliance on Commonwealth government activity, but with little success.

In fact, the ACT economy has experienced a long-term trend of an increasing share going to the Commonwealth Government, and a commensurately decreased share going to the private sector (households and businesses) as illustrated in Chart 1.

Typically, reliance of a business on a single customer, or of an economy on one particular sector (for example, mining), has risks.

However, in the case of the ACT there are significant benefits that outweigh such risks.

The Commonwealth Government will not close shop and leave. Its presence provides a certainty and stability to the economy that is not enjoyed by other jurisdictions. During national economic downturns or shocks, the ACT’s economy remains largely immune or generally fares better than the states or the NT due to countercyclical Commonwealth spending.

The rating agencies always refer to the Commonwealth presence as a factor in their considerations and assessment of ACT’s credit worthiness.

We do not understate the importance of the private sector. Household consumption and private investment are the engine room of an economy and should be considered as such for the ACT.

ACT government consumption and investment comprise merely 10 per cent of total economic activity.

Any strategy that seeks to boost the economy through increased territory government spending (whether recurrent or capital), or to compensate for a slowdown in Commonwealth spending, will be ineffective and is misconceived. In reality, its taxation, land supply and service delivery policies will have a far larger impact on the growth of the private sector.

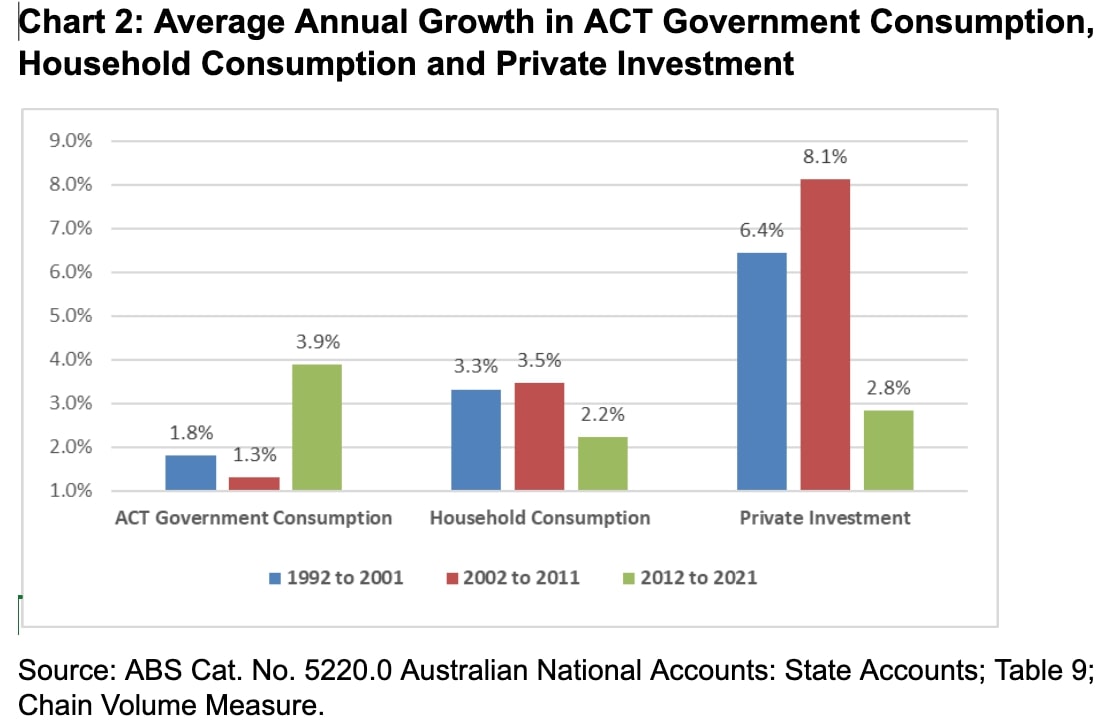

Over the last decade, the ACT’s economy has grown well below trend, with average annual growth at 2.9 per cent compared to 4.9 per cent in the previous decade.

It is relevant to note that a significant contributor to this below-trend growth is the performance of the private sector, as highlighted in Chart 2.

Average annual growth in household consumption (2.2 per cent) and private investment (2.8 per cent) are significantly lower in the last decade compared to the previous two decades (1990s and 2000s).

On the other hand, ACT government consumption tripled from 1.3 per cent in the second decade to 3.9 per cent in the last decade.

It is notable that even excluding the pandemic years has no impact on the ACT government’s consumption growth rate, and makes only a marginal difference to household consumption and private investment growth rates.

The inter-decade variations in growth are, therefore, structural in nature and unrelated to the recent economic shock.

In summary, it is difficult to see how Light Rail – Stage 1 could be envisaged as diversifying the economy.

ACT government spending fuelled by deficits and debt, and uneconomic projects such as this have, in fact, a deleterious effect on household consumption and business confidence.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply