“Without soundly based strategies, what makes Canberra a great place to live – access to services, transport, employment, health, education and nature – will continue to diminish,” says planning columnist MIKE QUIRK.

The ACT government’s housing policies are failing.

Between 2012 and 2023, despite an increase in population of more than 90,000, it did not increase the number of public housing dwellings.

Its infill policy has contributed to higher house prices, while too many redevelopment dwellings are examples of “dumb density”, hindering community acceptability and characterised by poor privacy and solar access, inadequate parking, congestion, vegetation loss and failing to meet the needs of occupants.

The recently released Indicative Land Release Program 2024-25 to 2028-29 identified 89 per cent of the intended supply of 21,422 dwellings would be multi-unit dwellings.

The program is based on the shaky foundations of the 2018 ACT Planning, which adopted a target of at least 70 per cent of new housing will be in the existing urban footprint in the belief it would deliver a more efficient and sustainable city.

The target was not based on assessments of housing affordability, housing preferences, environmental, travel and the infrastructure costs of alternative distributions of population and activity.

Similarly, the government hopes its 2024-2025 Statement of Planning Priorities will improve housing access, choice and affordability and assist in the building of thousands of new homes including the development of missing middle housing (townhouses, duplexes, terraces).

But, how for example, would the provision of missing-middle housing improve housing affordability? Without soundly based strategies, what makes Canberra a great place to live – access to services, transport, employment, health, education and nature – will continue to diminish.

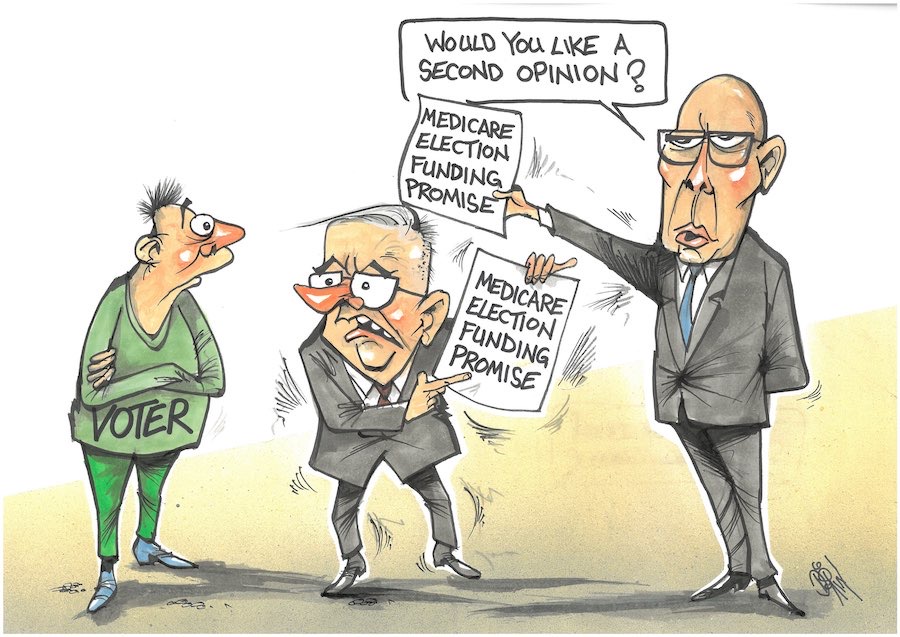

The ACT’s response is similar to other governments. Rather than developing a policy framework that would significantly improve affordability, statements are made suggesting effective action is being undertaken.

As Alan Kohler argued in his Quarterly Essay, nothing will change until politicians take the necessary, but unpopular, actions that reduce the benefits enjoyed by the house-owning majority, a major cause of the escalating inequality between property and non-property owning households.

The Albanese government’s plan is to build 1.2 million houses over five years with the states agreeing to expedite zoning, planning and land release to deliver more social and affordable housing in well-located areas. The hope is the new dwellings will bring down prices and improve affordability.

Steven Rowley, from Curtin University, observed the Albanese target is unlikely to be met as it requires building 60,000 new dwellings every quarter for five years. The industry is currently delivering around 40,000 new homes a quarter. Even if the increase in housing supply was achieved, it is far lower than the level needed.

Planning and zoning restrictions and delays in approving development applications are often argued to have hindered the development of sufficient housing.

Nicole Gurran, from Sydney University, demonstrates the planning system is not as great a problem as some argue. Between June 2020 and 2021, 221,000 dwellings were approved, but only 136,000 commenced. A year later, only 133,000 had been completed.

The fundamental issue is developers will only build if they can make a profit. Labour shortages, increasing prices of building materials and more expensive finance militate against higher levels of construction, as reflected in the inability of the ACT government to reach its land-release targets.

The supply problem, she argues, also stems from Australia being too dependent on the private market to deliver new homes with the proportion of homes built by the public sector having fallen from more than 10 per cent in the mid-1980s to about 2 per cent.

The winding back of capital gains tax and negative-gearing concessions would assist in funding the large increase in social housing required. Such incentives encourage investors to bid against intending homebuyers and consequently push up house prices.

Recent data indicates only 12 per cent of property investment loans were to build new homes. The suggestion by Senators Pocock and Lambie, to limit negative gearing to one investment property to increase its political acceptability, was met by a cold response from the major parties.

Proposals to allow superannuation to be used to finance house purchases, like first home buyer assistance, simply increase demand and house prices and do not increase supply.

Both Labor and the Coalition propose to reduce housing demand and infrastructure shortfalls by cutting immigration. Determining an appropriate level of net overseas migration, somewhere south of 200,000 a year, requires consideration of how to overcome skill shortages in areas including construction, health, aged care, hospitality and education; skills training and reducing the dependence of universities on foreign students.

Lower interest rates would stimulate both the construction and the demand for housing. Given the lagged supply response careful management (eg, lending restrictions) will be needed to avoid price increases.

The acceptance of major reform will be challenging as it requires many in the community being persuaded to act against their self-interest.

Governments need to demonstrate the reforms are necessary and soundly based. This is made even more difficult when questionable projects such the Canberra light rail, Melbourne’s suburban rail link, Snowy 2.0 and inland rail freight receive greater funding priority than housing. Governments lack credibility given the chasm between their actions and their rhetoric.

Mike Quirk is a former NCDC and ACT government planner.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply