“Now that interest rates have begun to rise the debt, the inexorable increase in which the residents of Canberra have blithely and dangerously ignored, will assume real and worrying significance”. JON STANHOPE and Dr KHALID AHMED analyse the Chief Minister’s latest Budget review.

ACCOMPANYING the ACT government’s 2021-22 Budget Review last month was a media release from the chief minister titled “ACT Budget Review: cautious optimism as economic recovery drives $475m fiscal improvement”.

Chief Minister Andrew Barr went on to claim that “the ACT’s economic recovery is continuing to progress with surging employment, strong consumption and an improving budget position for the territory.”

The phrase “cautious optimism”, which was employed by the chief minister is often used by media correspondents and commentators to describe the economic outlook and to forecast recovery.

However, the term is vague and capable of application to a range of scenarios. Interestingly, the term is also subject to a range of definitions, including for example, the following: “hopeful about something, but recognising the problems involved”; “a feeling that there are some reasons to hope for a good result, even if you do not expect complete success or improvement”; “believing something good will probably happen but lacking total confidence that it will definitely occur”; and “a euphemistic (yet silly) way of saying ‘worried‘”.

It is not clear which of these possible definitions of “cautious optimism” the chief minister had in mind.

One is therefore left wondering whether the treasurer is confident of recovery, is hopeful there will be a recovery but is not certain, or he is simply worried.

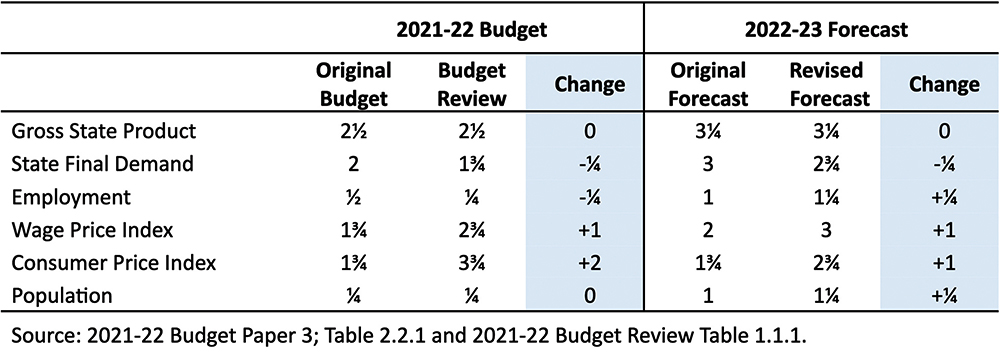

The answer can most likely be found in an analysis of the latest forecasts. The following table provides economic forecasts for 2021-22 and 2022-23 in the original Budget, Budget review and the change in each of the parameters.

The above table highlights that for the current financial year, as well as for the coming year, the forecast of economic activity as measured by State Final Demand has been reduced. The forecast of economic output as measured by Gross State Product remains unchanged for both years. The employment growth rate for 2021-22 has been halved. These updates are hardly reflective of economic recovery and surge in employment, as claimed by Mr Barr. Source: 2021-22 Budget Paper 3; Table 2.2.1 and 2021-22 Budget Review Table 1.1.1.

The Budget Review predicts an increase in wages with the Wage Price Index forecast to increase by 1 per cent from the original forecasts both in the current and coming year. Most importantly, inflation as measured by the changes in Consumer Price Index, is now forecast at 3¾ per cent, which is a 2 per cent upward revision, and 1 per cent above the rate of wage growth. With increase in inflation and lagging wage growth, many households are doing it tough.

For the coming year, the Budget Review forecasts inflation to fall to 2¾ per cent, below the rate of wage growth, and employment growth to pick up from ¼ per cent in the current year to 1¼ per cent.

These forecasts were based on an assumption that the conflict in Ukraine would have no material effect on economic activity beyond the September quarter 2022, and that the Reserve Bank of Australia would not raise interest rates earlier than indicated in its February 2022 statement. These were potentially heroic assumptions.

The RBA has, as many commentators predicted, raised interest rates in view of the significant increase in public spending and secondly the war in Ukraine is clearly not evolving according to the initial script.

In any event, regardless of the overly optimistic assumptions, the published forecasts are not indicative of a surging economic recovery.

The ACT government has also announced new infrastructure projects totalling $186 million, with infrastructure expenditure now forecast at $6.596 billion over five years. An important issue that is surprisingly not covered in the media release accompanying the Budget Review, but which is revealed by comparing it with the original Budget papers, is that there will be a capital underspend of $58 million in the current year. If the past performance is any guide, and in an environment of supply constraints, escalating costs and labour shortages the underspend will be significantly higher and cost overruns highly likely.

In the operating budget, the Budget Review forecasts an increase in revenue at an average of $214 million a year to 2024-25, including the current year, of which around $155 million per year is ongoing revenue. More than 84 per cent of the ongoing revenue is from the Commonwealth in GST payments and grants. Expenses are forecast to increase at an average of $94 million a year over the same period, as a result, the Budget Net Operating Balance improves by an average $120 million per year. The operating budget deficit in 2024-25 has reduced from $739 million to $636 million.

The treasurer’s media release referred to a $475 million improvement in the operating balance over the four years to 2024-25. On that basis, the operating budget will need to improve by more than $2 billion over coming years to return the Budget to balance.

The main contributor to the improvement in the ACT’s operating budget has been the Commonwealth government through an additional $105 million a year in GST and $27 million a year in Commonwealth Grants.

Payroll tax will also increase by $24 million a year and in what is surely embarrassing for Mr Barr, revenue from conveyance (stamp) duty, a tax he has repeatedly stressed is highly inefficient and that he announced over a decade ago would be abolished, will increase by $45.2 million in the current year alone. This is largely driven by the staggering increase in house prices which are, in the main, due to the ACT government’s monopolistic land supply policies.

Dividend revenue from entities such as the Suburban Land Agency and ICON Water will also increase by $48.4 million in the current year.

The overall trajectory in the Budget Review remains one of persistent deficits, with expenditure growth of 3.5 per cent a year (3.1 per cent in the original Budget) remaining above the revenue growth of 3.2 per cent a year (2.4 per cent in the original Budget).

The Budget Review forecasts net debt to grow to $9.1 billion in 2024-25 compared to $9.6 billion in the original Budget. The Net Debt to Revenue ratio (NDR), a measure that ACT Treasury officials confirmed, in the course of a recent Public Accounts Committee hearing, that the rating agencies focus on, is set to increase from 69 per cent in 2020-21 to 127 per cent in 2024-25 compared to 138 per cent in the original Budget. When, and it is clearly a case of when and not if, interest rates begin to rise then the debt, the inexorable increase in which we, the residents of Canberra have blithely and dangerously ignored over the last decade, will assume real and worrying significance.

To provide some context to the current state of the ACT’s finances, when in 2011 the then Chief Minister Katy Gallagher entrusted Andrew Barr with the treasury portfolio the Net Operating Balance was a surplus $42 million and the NDR was negative 12 per cent. In the decade since then, Mr Barr has converted the surplus $42 million operating balance into a deficit of $985 million, a worsening of more than $1 billion in the Budget position and has converted the NDR he inherited from minus 12 per cent to positive 127 per cent, a worsening of 139 per cent.

And no, this massive turnaround cannot, in the main, be attributed to COVID-19.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply