Annual interest costs on ACT government debt will hit $517 million in 2025-26. That’s more than the government spends on environmental protection, the police and mental health services combined. We’re in trouble. JON STANHOPE and KHALID AHMED explain why…

THE deep structural weakness of the Budget has not only limited the ACT’s capacity to respond to the pandemic, but is also reflected in the ongoing deficits of a similar magnitude, which only the ACT is enduring, while all other states and the NT return to surplus.

In the previous article in this series looking at the state of the ACT’s operating Budget, we referred to the persistent deficits in the seven years before the pandemic.

We also noted that the 2022-23 ACT Budget forecasts a deficit every year up to 2025-26 and that not only will the ACT be the only jurisdiction still in deficit in that year but that the ACT will also, by then, have posted a deficit for 14 consecutive years.

In 2012, when then chief minister Katy Gallagher handed the Treasury to Andrew Barr, the Budget had been in surplus for three years, and net debt was negative $473 million. In other words, the ACT’s cash reserves and investments were larger by that amount to borrowings.

However, the Barr government’s increase in debt before the pandemic was already unsustainable.

For example, from 2012-13 to 2018-19, the sum of the operating deficits was $1.616 billion and net debt increased by $2.1 billion. It is, therefore, simply incorrect to suggest that the ACT’s current debt is a consequence of the pandemic.

We have previously expressed serious concern about the ACT’s rising debt, the prospects of its stabilisation and eventual repayment as well as the implications for future generations of Canberrans who will inherit it.

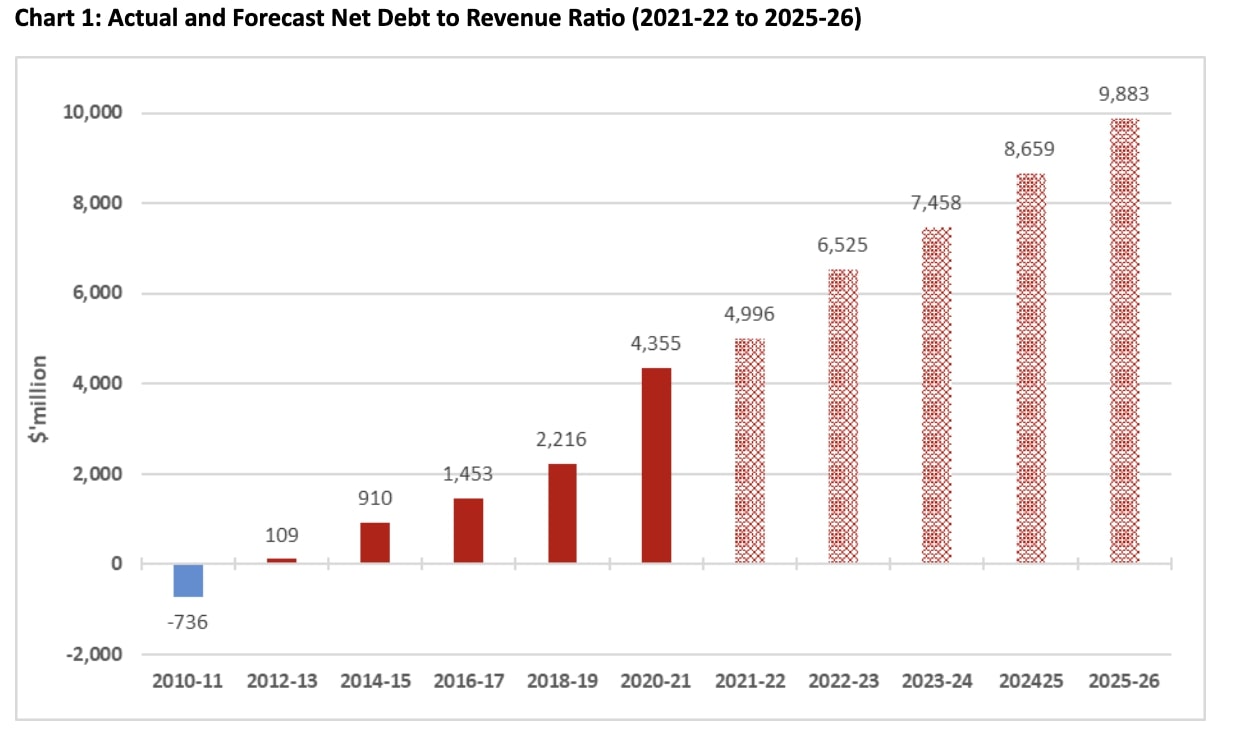

The reason for our concern at the magnitude of both the operating deficits recorded in the ACT and the levels of debt we are accumulating is that they will inevitably need to be financed through large-scale asset sales or further borrowings, significant increases in taxes and major cuts in services. The trend in CHART 1 highlights the basis of our concern.

Over the Budget and forward estimates period, net debt is forecast to almost double from $4.996 billion in 2021-22 to $9.882 billion in 2025-26.

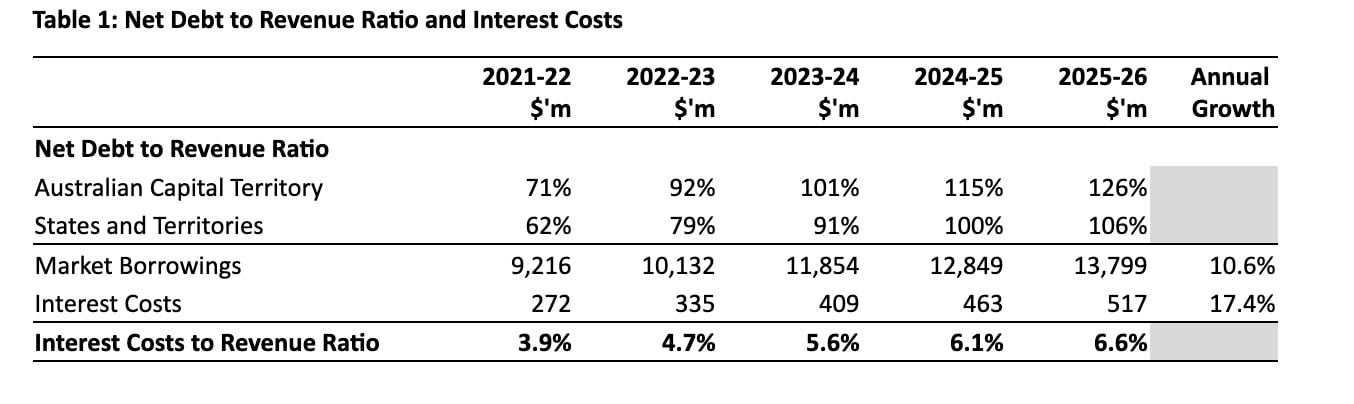

The net-debt-to-revenue ratio is a standard measure of the capacity of the operating budget to service debt. TABLE 1 reveals that the ACT’s net-debt-to-revenue ratio is forecast to rise faster and higher than the weighted average of all states and territories – a remarkable achievement given that just a decade ago, the territory had negative net debt.

Persistent operating deficits and the consequent increase in debt not only transfer a financial burden to future generations, but they also have implications for the level of services currently available.

As TABLE 1 shows, interest costs on our debt are forecast to increase from $272 million in 2021-22 to $517 million in 2025-26.

To put this in perspective we will be paying more on interest costs than the government has budgeted for environmental protection, police services and community mental health services combined.

As an illustration of the squeezing effect the rising debt will have on the operating budget, funding for the services mentioned above actually decreases at an annual rate of 3.2 per cent over the Budget and forward estimates, while interest costs increase at a rate of 17.4 per cent a year.

A surplus is not, of course, an end in itself. A balanced budget, however, is a means to ensure the sustainability of priority services to meet community needs. A surplus provides a buffer against fiscal shocks and allows the government to preserve services without a debt burden. Therefore, fiscal discipline is a critical enabler for the delivery of a government’s core functions, and as such a fundamental principle of public financial management.

Section 11(5) of the Financial Management Act 1996 (FMA) imposes an explicit obligation on the ACT government through the Treasurer to ensure that the annual ACT Budget is consistent with and reflects the principles of responsible fiscal management. The FMA contains the following definition of the principle:

(a) ensuring that the total liabilities of the Territory are at prudent levels to provide a buffer against factors that may impact adversely on the level of total Territory liabilities in the future, and ensuring that, until prudent levels have been achieved, the total operating expenses of the Territory in each financial year are less than its operating income levels in the same financial year;

(b) when prudent levels of total Territory liabilities have been achieved, maintaining the levels by ensuring that, on average, over a reasonable period of time, the total operating expenses of the Territory do not exceed its operating income levels;

(c) achieving and maintaining levels of Territory net worth to provide a buffer against factors that may impact adversely on levels of Territory net worth in the future;

(d) managing prudently the fiscal risks of the Territory;

(e) pursuing spending and taxing policies that are consistent with a reasonable degree of stability and predictability in the level of the tax burden;

(f) giving full, accurate and timely disclosure of financial information about the activities of the government and its agencies.

We have previously estimated that if per capita health expenditure in the ACT had grown at the national average level, hospital services would have received around $238 million more in 2018-19 than was the case.

We have also noted, with regards to infrastructure, that in 2015-16 a $1.3 billion planned redevelopment of the Canberra Hospital precinct was scaled back to less than half of the scope, and then deferred repeatedly.

Likewise, oft floated, planned and promised economic infrastructure projects, such as the convention centre and stadium, have been abandoned.

The debt which the ACT has accumulated due to deep deficits and high interest costs has clearly forced the redirection of funds from services and infrastructure. We believe it is unarguable that the liabilities of the territory are not at a prudent level.

Section 11(6) of the FMA allows a departure from the principles of responsible fiscal management under the following conditions and terms:

The proposed budget may depart from the principles of responsible fiscal management, but if it does depart—

- any departure must be temporary; and

- the Treasurer must present to the Legislative Assembly, when the first Appropriation Bill for the financial year is presented to the Legislative Assembly, a statement setting out—

(i) the reasons for the departure; and

(ii) the approach intended to be taken to return to the principles; and

(iii) when the principles are expected to be returned to.

We do not believe a timeframe of seven years before the pandemic to four years after the pandemic, can be considered “temporary”.

To our knowledge no statement consistent with Section 11(6) of the FMA has been tabled by the Treasurer. We are aware of repeated and vague promises in successive Budgets, that the government is on track to return the Budget to balance, but are yet to see any detail about how that is to be achieved. This may, of course, not reflect the failure of such a plan but rather that there is no plan.

The FMA provides, explicitly, that the operating expenses of the Territory do not exceed its operating income levels.

We believe the challenge this legal requirement presents the ACT government goes beyond the operating Budget and will, as a minimum, require a major change in fiscal strategy, including, for example, the reprioritising of investment in infrastructure.

A link to the first in this two-part series by former chief minister Jon Stanhope and former senior Treasury officer Dr Khalid Ahmed is below:

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply