The Greens’ demands on the RBA make for bad economic policy. Is it also crazy politics, asks political columnist MICHELLE GRATTAN.

When the Greens tell Labor they’re ready to negotiate, what they usually mean is they’re preparing to make populist demands that can’t or shouldn’t be met.

So it is with their “ask” on the Reserve Bank legislation.

Treasurer Jim Chalmers wants to split the Reserve Bank board into two, one to run monetary policy and the other to administer the bank.

He got close to agreement with the Liberals, but then they saw an advantage in walking away. The Greens jumped in to fill the void, demanding an interest rate cut in exchange for their support.

“Both the Treasurer and the RBA Governor have said the reforms are important. Now they know what they have to do to get them done – provide some much needed relief to mortgage holders,” the minor party’s treasury spokesman Nick McKim said on social media on Monday.

“We are unashamedly using our political power to fight for mortgage holders who are getting smashed by high interest rates.

“The power exists for the Treasurer to bring down interest rates. Time to stop the pretence that the RBA is independent.

“Time for Jim Chalmers to end his ritual ashen-faced handwringing, end the pretence there’s nothing he can do, and intervene to bring down interest rates,” McKim said.

“We are deliberately bringing the RBA into the centre of the political debate where it belongs. The RBA board are unelected technocrats, not high priests who are beyond criticism. Every decision they make is political.”

When it comes to the Greens, the government gives as good as it gets.

“The Greens are out of control,” Finance Minister Katy Gallagher told the ABC on Monday. “It’s crazy what they’re saying to us,” adding, rather primly, that it was “a bit unseemly” for McKim to be “issuing ultimatums”.

Leave aside the unseemly – that’s a common political trait. What about the crazy?

What the Greens are demanding is bad economic policy. Whether it is crazy politics remains to be seen.

From time to time the Reserve Bank comes under sharp criticism, from experts and from the public.

Chalmers and McKim agree on one thing – the “smashing” power of high interest rates.

But the bank’s essentially independent status is a bulwark against monetary policy becoming the creature of short-term politics, as McKim would have it.

(The bank isn’t totally independent. Section 11 of the RBA Act gives the treasurer the power to overrule it, with statements from both the treasurer and bank tabled in parliament. The section has never been invoked.)

What the Greens are proposing, having the treasurer use his power to overrule the bank board to get his way on legislation, is irresponsible.

It’s also illogical. The whole point of the proposed dual boards is to strengthen the bank’s expertise as the independent setter of monetary policy. But McKim wants, in essence, to scrap that independence.

The stand on the Reserve Bank is typical of the Greens policy positions more generally. They’re presently holding up the government’s housing legislation in the Senate, making demands they know the government won’t meet, such as controls on rents.

When challenged, the Greens point out that after playing hardball on earlier housing legislation, they won extra funding.

They’re probably hoping the government will decide to buy them off this time with some more housing money. Notably, they have delayed the latest bills rather than vote them down. To do this they’ve teamed up with the Coalition – expediency overcomes ideology with these bedfellows.

Monday’s announcement that the Australian Competition and Consumer Commission has launched legal action against Coles and Woolworths over their allegedly misleading behaviour on product discounts feeds right into the Greens’ (and the Coalition’s) policy for the power to break up the big supermarkets.

The government reacted on Monday by releasing an exposure draft of its mandatory food and grocery code of conduct, which has been in the pipeline for some time. A government inquiry by former Labor minister Craig Emerson argued against divestiture powers but it’s easy to understand how cash-strapped families struggling with grocery bills could see that as appealing.

In general, is wild economics savvy politics? We won’t know until after the election.

The Greens were on a roll in 2022. They ended up with four lower house members, up from the one (leader Adam Bandt) they had before. The extra seats, all in Queensland, were won from both Labor (one) and the Liberals (two).

They also came out of the election with a record dozen senators (now 11, after Lidia Thorpe’s defection).

In the hunt for more lower house seats, the Greens would hope to pick up votes from those on the left who see Labor as too conservative, people financially hurting who are attracted to populist solutions, and young voters turned off the major parties.

Given its present radicalism, one wonders whether the Greens will hold the two Brisbane seats they won from the Liberals.

It’s difficult to chart the likely trajectory of the Greens, given their small share of the vote, and the heavier concentration of their support in particular areas. But Labor is certainly afraid of them. With the government on the back foot, it knows the potential attraction of easy-sounding solutions.

The Greens hope there will be a minority Labor government after the election, and that they would be in a position to twist that government’s arm on multiple issues.

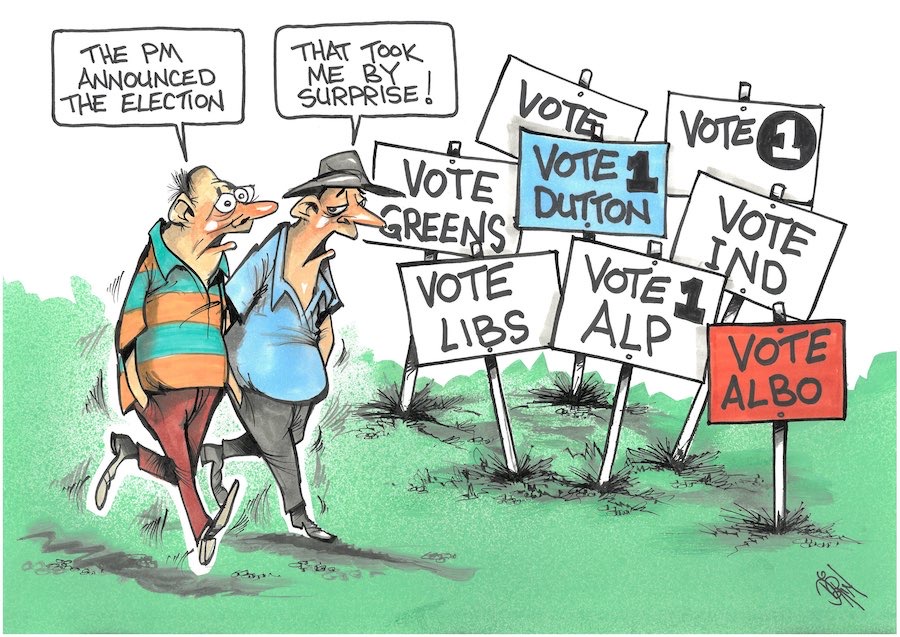

The risk for them, however, is that if they overreach now, some of their potential but still undecided voters might become wary about how they would behave if their power was much enhanced.![]()

Michelle Grattan, Professorial Fellow, University of Canberra. Republished from The Conversation.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply