Millions of patients could end up paying more as a feud between insurance funds and a company operating dozens of private hospitals escalates.

The termination of contracts between hospital operator Healthscope and the funds will affect patients at 38 private hospitals, who could be forced to pay greater out-of-pocket costs to access care despite their insurance.

The move will impact customers with Australia’s second-largest health insurer, Bupa, and others in the Australian Health Services Alliance.

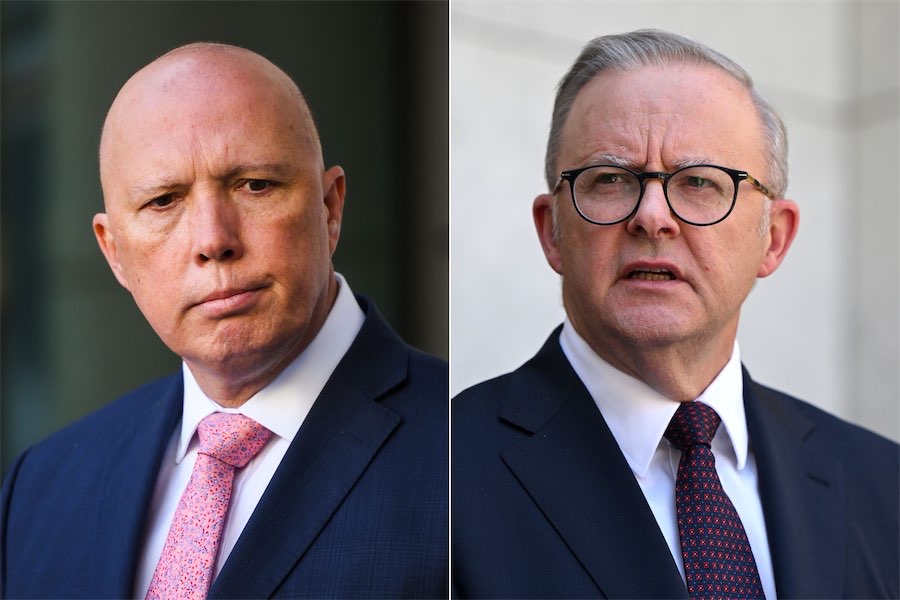

Health Minister Mark Butler said tearing up contracts was not in the interests of patients.

“I expect them to get back to the table and fix this,” he said.

“(Healthscope and Bupa) are big, sophisticated, foreign-owned commercial operators … they are able to continue their commercial operations underpinned, essentially, by taxpayer support,” he said.

The axing of various contracts would take place in February and March, Healthscope announced on Friday.

It said insurers refused “to acknowledge the viability crisis impacting private hospitals by addressing Healthscope’s funding concerns”.

Healthscope chief executive Greg Horan said the operator was committed to providing the best possible care “but we can only do this if we are adequately funded”.

“For us to remain viable, we are left with no choice but to terminate the contracts,” he said.

Bupa chief executive Nick Stone said the insurer was shocked and deeply disappointed.

“They appear to be disregarding the interests of our shared patients and customers by seeking to impact their access to health care,” he said.

Bupa considered Healthscope’s claims against the insurers unfounded, he said.

Brett Heffernan, from peak body Australian Private Hospitals Association, said the system was “out of whack”, with insurers making record profits while some 20 private hospitals had closed in recent years.

“Without a mechanism that ties premium increases to payments for care in private hospitals, any premium increase next year is just lining insurance company coffers,” he said.

“If there is nothing compelling insurers to meet the true costs of care, the experience is they simply won’t do it.”

Insurer lobby Private Healthcare Australia said the hospital operator would end up charging patients to increase its profits.

“If Healthscope was serious about delivering patient care to Australians in a cost-of-living crisis it would negotiate an affordable and sustainable outcome, rather than throwing its toys out of the cot,” chief executive Rachel David said.

Opinions differ over how much it could cost patients.

Healthscope said Bupa and alliance fund members could pay “potentially in the hundreds of dollars or more”, while Dr David said patients might face increases in the thousands.

NSW Treasurer Daniel Mookhey previously accused some funds of “robbing” the state’s system to the tune of $140 million a year by contributing significantly less than the average daily cost of public hospital beds used by private patients.

Data from the national health regulator showed Australians paid $27.3 billion in premiums and made $22.6 billion in claims in 2023.

The average fund recorded a net margin after management expenses of 6.6 per cent.

Healthscope operates 13 hospitals in NSW, 10 in Victoria, five in Queensland, four in South Australia and one in each of the other states and territories.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply