“How many Canberrans, or other Australians, really need more than $3 million to carry them through from retirement until their demise? Who needs more than this sort of money to have a comfortable retirement?” writes political columnist MICHAEL MOORE.

GET a grip. As the American statesman, Benjamin Franklin, pointed out: “In this world nothing can be said to be certain, except death and taxes”.

The fear campaigns of the Liberals regarding taxes, tap into the more selfish or greedier parts of our personalities.

The latest example has the Liberals taking on a government intent on increasing superannuation taxes where there is more than $3 million in accumulated funds. This plays into the hands of federal Opposition Leader Peter Dutton. It also really upsets the rich who have been using superannuation as a tax-minimisation measure to accumulate wealth.

However, it is not just the issue of paying a fair contribution of taxes. This debate also raises the issue of the purpose of superannuation. Are superannuation savings set aside to increase wealth or to ensure that, as people step out of paid work, they have the potential to enjoy their retirement years based on sensible accumulation of their contributions.

Paying a low rate of 15 per cent taxation on superannuation has proved a powerful incentive for people to save. This lowers the pressure on a range of social services and pension sectors and reduces demand on government expenditure. At the same time, it allows people who have superannuation savings to have a wider range of choices about how they live in retirement.

The superannuation system was not designed for wealth accumulation. Treasurer Jim Chalmers announced the intention to focus on those with more than $3 million in superannuation. Instead of asking them to pay tax at 32.5 per cent, 37 per cent or at 45 per cent – he still allowed a concessional rate of 30 per cent.

It is likely that the rich people who have accumulated this much money in their superannuation accounts would otherwise be paying taxes at the highest level of 45 per cent. Some people have been (legally) using the superannuation loophole in order to minimise the level of taxation that they were paying.

It may have been legal… but so were the “bottom-of-the-harbour” tax-evasion schemes that were operating in the ’70s. Such schemes were eventually made illegal in 1980. Originally, they were legal. However, they were also immoral. This poses the question about how ethical are schemes using superannuation specifically to minimise the taxes of the very wealthy.

‘Who really needs more than $3 million?’

How many Canberrans, or other Australians, really need more than $3 million to carry them through from retirement until their demise? Who needs more than this sort of money to have a comfortable retirement?

Keep in mind that this accumulation of wealth is beyond ownership of the family home. On the family home there are no taxes payable on increasing value. For those with more than $3 million invested in superannuation, there is a fair chance that they do not live in a hovel or rented accommodation. It is appropriate to apply an increased tax at a rate of 30 per cent on more than $3 million in accumulated superannuation.

The announced tax increase does not stop people with large sums of money from investing and earning from those investments. Good on them. However, the common good is achieved with a fair tax system.

The common good includes effective health systems for all – not just for the rich. The same is true for education, housing, the range of social services, the justice system and defence of the nation. There are good reasons to pay taxes.

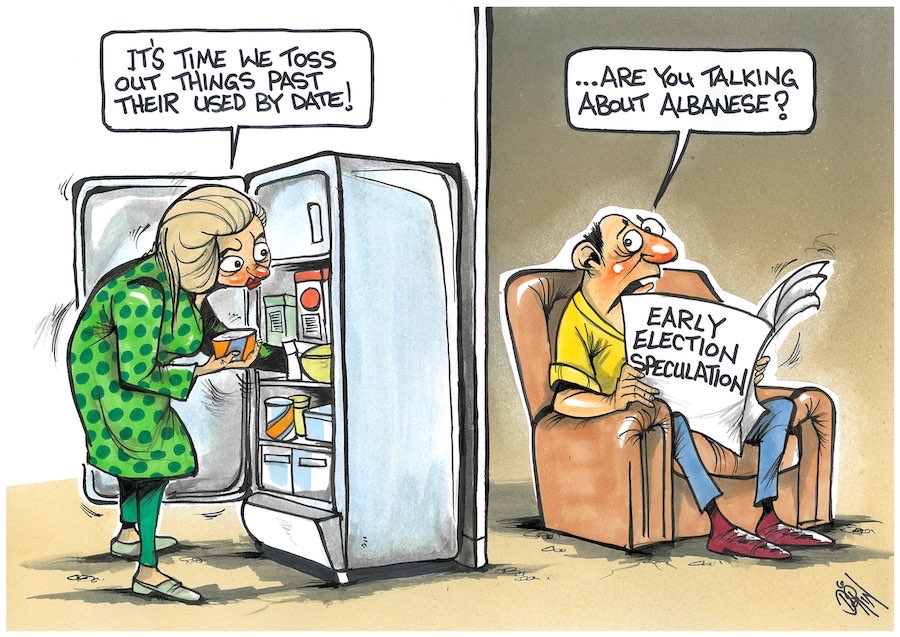

However, Dutton and his cronies continue to run fear campaigns on taxation. Get a grip. The conservatives within the Liberal Party love to run these anti-tax campaigns.

Who cares about the truth? The “super-mining” tax, Tony Abbott’s constant use of “just another great big tax” does have some appeal. The common good, however, demands a reasonable level of taxation through an equitable system.

The slippery-slope argument followed immediately. Dutton was quick to predict that this is just the first of many increases in taxation. He has no evidence. But when was evidence necessary in the politics of opposition?

The sensible approach of ACT independent senator David Pocock in supporting these changes should remind Canberrans why it is that he was selected by the voters to replace the conservative Zed Seselja.

Michael Moore is a former member of the ACT Legislative Assembly and an independent minister for health. He has been a political columnist with “CityNews” since 2006.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply