“ACT debt will increase at the rate of $3.2m every single day. Over this period, interest will increase from $250m to $595m annually.” JON STANHOPE and KHALID AHMED forensically unpick this year’s ACT budget spin.

EARLIER this year the UK Statistics Authority (UKSA), following a complaint by an opposition member of parliament, reprimanded Chancellor Jeremy Hunt for claiming that public debt levels in the UK would fall in the coming years.

In fact they were simply forecast to rise less steeply than previously expected.

The head of UKSA wrote to the MP who made the complaint advising that they had spoken with “officials at HM Treasury to emphasise the importance of consistently adopting a transparent and accessible approach to communicating statistics and data in line with our guidance on intelligent transparency.”

Here, in the ACT, Treasurer Andrew Barr’s media release on the 2023-24 Budget advised:

- Key balance sheet metrics for 2023-24 – net debt, net financial liabilities and net worth – are all broadly comparable with the estimates presented in the 2022-23 Budget Review.

- Total revenue has increased by greater than total expenses over the three years from 2023-24 to 2025-26 compared to the 2022-23 Budget Review.

- This reflects the government’s commitment to the principles of good fiscal management: sustainable economic growth; sound public finances; quality and efficient services; sustainable taxation and revenue, and a strong balance sheet.

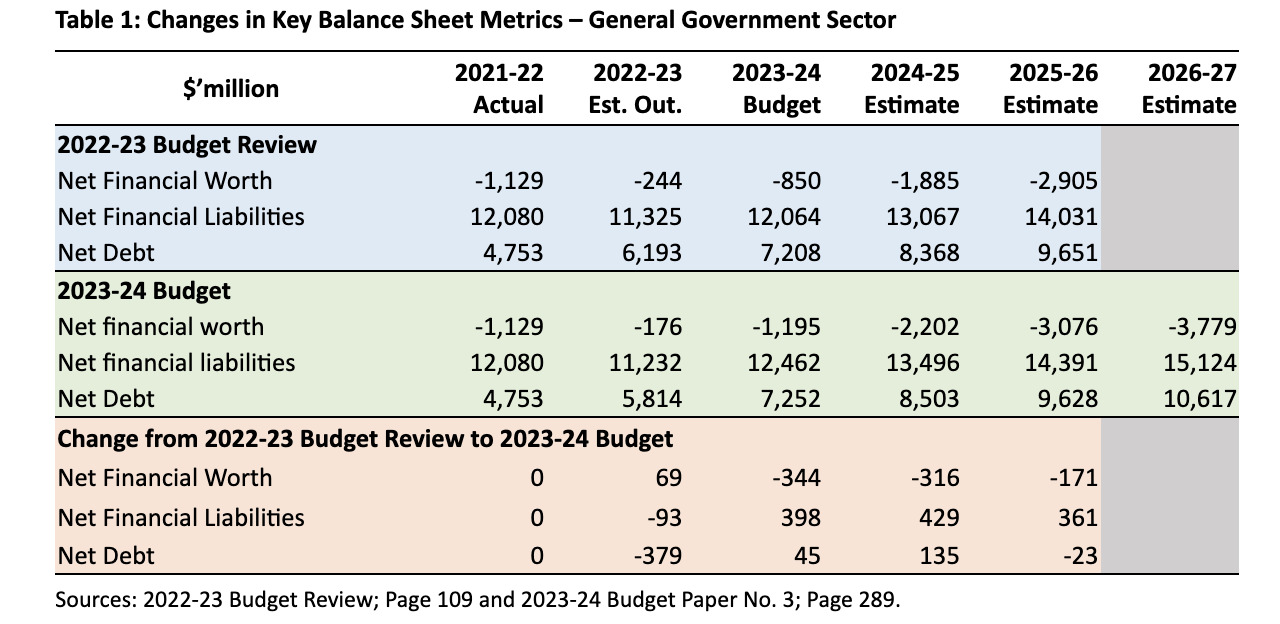

Table 1 provides the actual key balance sheet metrics in the 2022-23 Budget Review, 2023-24 Budget and the changes in those metrics from the Budget Review to the 2023-24 Budget, and on which Mr Barr presumably based his glowing press release.

The financial statements show, in fact, that Net Financial Worth is set to deteriorate by $344 million from a Budget Review forecast of negative $850 million to a negative $1.195 billion in the 2023-24 Budget – a 41 per cent deterioration from the Budget Review forecast and in addition, Net Financial Liabilities are forecast to increase by $398 million above the Budget Review estimate. Hardly what one would describe as “comparable”

It is highly unlikely, of course, that many of us will have taken the time to refer back to the Budget Review document published some months earlier when seeking to understand what has changed in the budget. We are nevertheless entitled, one would think, to expect that what the Treasurer has advised in his press release reflects the true budget position.

Having said that, we find it difficult to see how the key balance sheet metrics in the 2022-23 Budget Review and the 2023-24 Budget can reasonably be described as “broadly comparable”.

Equally concerning is that the Budget Papers, presumably prepared by an independent and professional Treasury, utilise the same description of the key metrics.

Of the three balance sheet metrics in the budget, only one – Net Debt – could be described as broadly comparable to the Budget Review. The media release, however, does not disclose that over the forward estimates period, Net Debt is forecast to increase at an average compounding rate of 17 per cent a year. It is forecast to more than double from $4.8 billion in 2021-22 to $10.6 billion in 2026-27 – increasing at an average of $1.173 billion every year.

To put it in perspective, the 2023-24 Budget forecasts an increase in Net Debt at the rate of $3.2 million every day including weekends and Easter and Christmas holidays. Over this period, interest costs will increase from $250 million to $595 million annually.

There is, of course, no official watchdog such as the UKSA in the ACT or indeed in any jurisdiction in Australia. However, if one existed, it is inconceivable that it would consider either Mr Barr’s media release or the budget papers’ descriptions of the balance sheet position as meeting the standards of “intelligent transparency”.

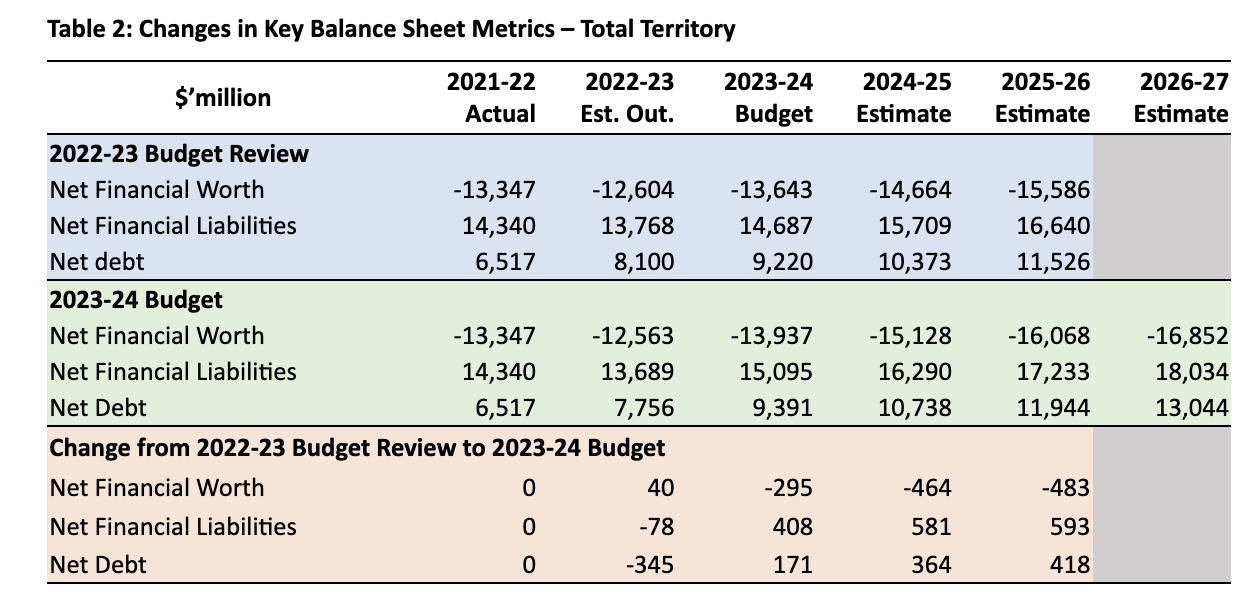

Our past analysis and commentary on the budget and that above relate to the General Government Sector. However, some analysts and observers of the public sector finances have pointed out that a more comprehensive picture is provided through the Total Territory financial statements and their key metrics, ie, consolidation of the General Government and Public Trading Enterprises sectors.

While there are arguments for focusing on general government operations when assessing the performance of the government, it is a fact that the territory does draw dividends from the trading enterprises and is also, ultimately, responsible for their liabilities.

Accordingly, Table 2 illustrates the key balance sheet metrics at the consolidated Total Territory level.

We note again that with changes in the order of $400 million-$590 million, the key balance sheet metrics cannot, with any credibility, be described as being broadly comparable with the Budget Review. We also note that Net Financial Worth deteriorates by $3.5 billion, Net Financial Liabilities increase by $3.7 billion and Net Debt increases by $6.5 billion over the five years of the estimates.

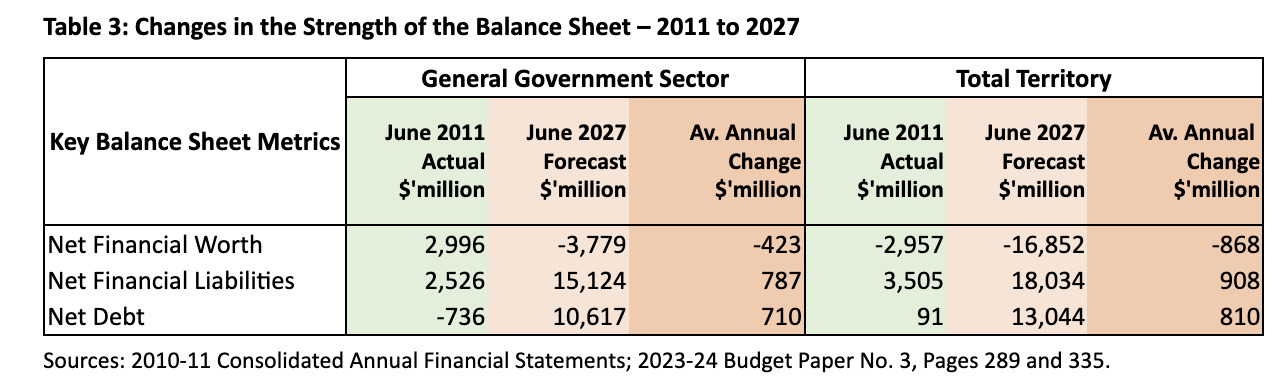

The ACT’s balance sheet is far from stable. In fact, the budget and forward estimates reflect the continuation of a trend that commenced more than a decade earlier. Table 3 illustrates the degree to which the strength of the balance sheet has been persistently and worryingly eroded since 2011.

Deterioration of this scale in the ACT’s balance sheet can, in our opinion, in no way be seriously claimed to reflect a commitment to sound financial management.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply