“Maintaining a ‘AAA’ credit rating has been one of the financial policy objectives of every ACT government since self-government – that is, other than the Barr government.” JON STANHOPE & KHALID AHMED look at the costly effects of the ACT’s credit-rating downgrade.

FOR years now we have warned about the ACT’s precarious budget position, including in particular, the massive increase in debt.

In a series of articles mid-last year (here, here and here) we examined the ACT’s operating budget and key debt metrics over the last two decades and expressed serious concern about the trend deterioration in the territory’s finances since 2012-13.

We concluded that “if the ACT government doesn’t refrain from further debt accumulation, a rating downgrade is inevitable.”

And now the ratings agency Standard & Poor’s (S&P Global) has downgraded the ACT’s credit rating from the coveted AAA to AA+, which comes as no surprise.

However, it is deeply concerning both for its implications for Canberra residents, as well as the apparent indifference of the Chief Minister and Treasurer, Andrew Barr, and Treasury officials to such a predictable and obvious outcome.

A “AAA” credit rating is not merely a token, and maintaining it is not an end in itself. However, a rating downgrade is a clear signal to lenders that the risk of lending to an entity suffering such a downgrade has increased, which inevitably results in higher interest costs.

Typically, this occurs when the level of debt exceeds certain limits. If, therefore, the ACT government does not respond with appropriate policy changes, debt will accumulate at an even faster rate with further downgrades again inevitable.

The only obvious policy changes open to the government are, of course, to either increase taxation or cut expenditure (services), or both. For this reason, maintaining a “AAA” credit rating has been one of the financial policy objectives of every ACT government since self-government – that is, other than the Barr government.

Loss of the ‘AAA’ rating has real consequences

For Canberra residents, most particularly the less well off, the loss of the “AAA” rating has real consequences. The burden of the ACT government’s taxation measures is not distributed progressively, impacting disproportionately on people on low-to-moderate incomes. For example, cuts in health care are particularly inequitable.

The ratings downgrade is irrefutable evidence that the fiscal strategy adopted by the ACT government is flawed. Maintaining a “AAA” credit rating has clearly been dropped as a financial policy objective.

A key measure of debt management and reporting, namely the Net Debt to Revenue Ratio, has also been dropped and replaced by the Net Debt to Gross State Product (GSP) Ratio, which is an irrelevant and misleading measure for a government at the sub-national (State and Territory) level.

Mr Barr, in responding to the media last year about the rapidly growing level of debt his government was accruing, provided an insight into his fiscal strategy when he advised that as the economy grows over time, the value of debt relative to the size of the economy will decline.

In other words, the treasurer advised that the problem will solve itself.

That advice is, of course, flawed. It’s a question of simple maths that if debt is rising faster than the growth rate of the economy, then debt as a proportion of the economy will continue to rise.

Indeed, the 2021-22 Budget Review, published under the authority of Mr Barr, forecasts the debt to GSP ratio will increase from 18 per cent in 2020-21 to 24 per cent in 2024-25.

We have assumed that the Budget Review forecast is correct and that Mr Barr had, it seems, been poorly briefed. Extraordinarily, however, a senior Treasury official told a Legislative Assembly Committee, at roughly the same time, that the Treasury was “not losing any sleep” over rising debt.

It is not unfair to suggest that they, and the treasurer, have nevertheless been asleep at the wheel and blissfully unconcerned about losing the “AAA” rating, which they must surely have known would happen.

Promised budget improvement has not occurred

We have no particular insight into the workings of S&P’s assessment; however, the following reported comments provide some interesting clues when they say: “The downgrade reflects the territory’s slower fiscal recovery from the pandemic than we expected. ACT’s after-capital account balance is larger, and its ratio of tax-supported debt to operating revenues is much higher, than those for all ‘AAA’ rated peers globally.”

S&P is clearly concerned that the oft promised improvement in the ACT budget has not occurred and it has clearly not been persuaded by Mr Barr’s regular assurances that the budget is on the mend.

Notably, it refers to two metrics, which ostensibly, among other considerations, are the crux of its decision – the “after-capital account balance” and “tax supported debt to operating revenue”.

The after-capital account balance reflects the cash available, or required, as the case may be, after taking into account operating and capital expenditure requirements.

The extent of a deficit reflects the amount that needs to be borrowed. In the 2022-23 budget, the cash deficit forecast for 2023-24 was $688.3 million, an improvement on the then forecast 2022-23 result. However, the 2023-24 budget revised this forecast to a deficit of $989.7 million, that is it blew out by more than $300 million and along with the territory forecast of the annual borrowings required to pay the interest on its debt over the forward estimates, seems to have been the trigger for the downgrade.

The ratio of tax-supported debt to operating revenues measures debt relative to revenue rather than the size of the economy, contrary to what the government has been reporting.

This measure appears to be more stringent in that it uses debt that must be paid from operating revenues (excluding commercial debt) rather than net debt.

The S&P assessment of the state of the ACT budget compared to other “AAA” rated entities globally suggests that the rating downgrade imposed on the ACT should have occurred earlier. Again, it is difficult to believe that neither the treasurer or the ACT Treasury were unaware of S&P’s calculus.

In seeking to defend his management of the budget in the face of the ratings downgrade, Mr Barr highlighted increased spending on pandemic support measures and other public health, cost-of-living and housing initiatives. We do not accept that these excuses have any merit.

Unbroken string of deficits and increasing debt

The genesis of the ACT’s budgetary problems is the unbroken string of deficits and the exponential increase in debt since Mr Barr became Treasurer in 2011 (there’s more here).

The ACT is also the only Australian jurisdiction not to have posted a surplus in the decade from 2012. In addition the ACT has posted the highest average deficit in Australia during that period.

In fact, S&P is reported to have observed that the ACT’s debt to operating revenue ratio had reached 93 per cent by 2018-19 (ie, before the pandemic). In that year, according to the national accounts, the ACT had a cash deficit of $1.065 billion.

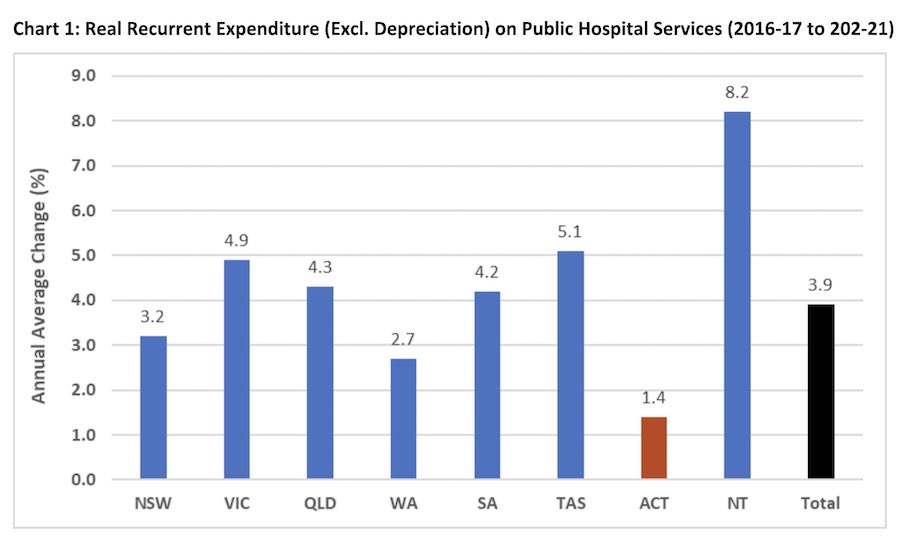

As for Mr Barr’s oft repeated mantra in relation to health expenditure, data available from the Productivity Commission reveals a very different picture.

Mr Barr has also claimed: “The government’s choice is to invest now, with a clear longer-term fiscal strategy to progressively improve the operating cash position and fully fund our superannuation liability. We know this supports intergenerational equity in our community”.

The statement, with its curious reference to “intergenerational equity”, is presumably aimed at appeasing the ALP’s coalition partner, the Greens.

Unfortunately, Mr Barr is again using an inappropriate measure in referencing intergenerational equity. While operating cash is important, it’s the after-capital balance – S&P’s statement provides a clue here – that determines the borrowings, the rate at which debt grows and debt servicing capacity.

We have previously observed that a Canberra child in primary school today will be repaying the debt accumulated by the ACT government over the last decade, well into their retirement.

That assessment was based on an assumption that the after-capital account, to use the S&P’s terminology, is not just in balance but in surplus. It is currently forecast to be in deficit every year to 2026-27. The Treasurer’s “strategy” will, therefore, bequeath even that child’s offspring with responsibility for paying off his debt.

We have noticed some commentary following the ratings downgrade that the ACT is not unique and is in fact in the same boat as other Australian jurisdictions with the exception of WA. That does not, of course, justify the spiralling debt and persistent deficits that characterise the ACT budget position.

In addition the ACT has a very limited capacity to sustain high debt levels particularly when compared to other jurisdictions, which have significant surety in substantial manufacturing, mining and agricultural bases.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply