Last week JON STANHOPE and Dr KHALID AHMED highlighted the extraordinary increase in Canberra house prices due to decisions taken by the ACT government to decrease the supply of land for most of the last decade. Here they look at the state of public housing.

WHILE the ACT government’s policy to decrease the supply of land has delivered it abnormal profits, there is a downside.

A significant proportion of Canberra households, including many with moderate incomes, have been locked out of home ownership and locked into renting.

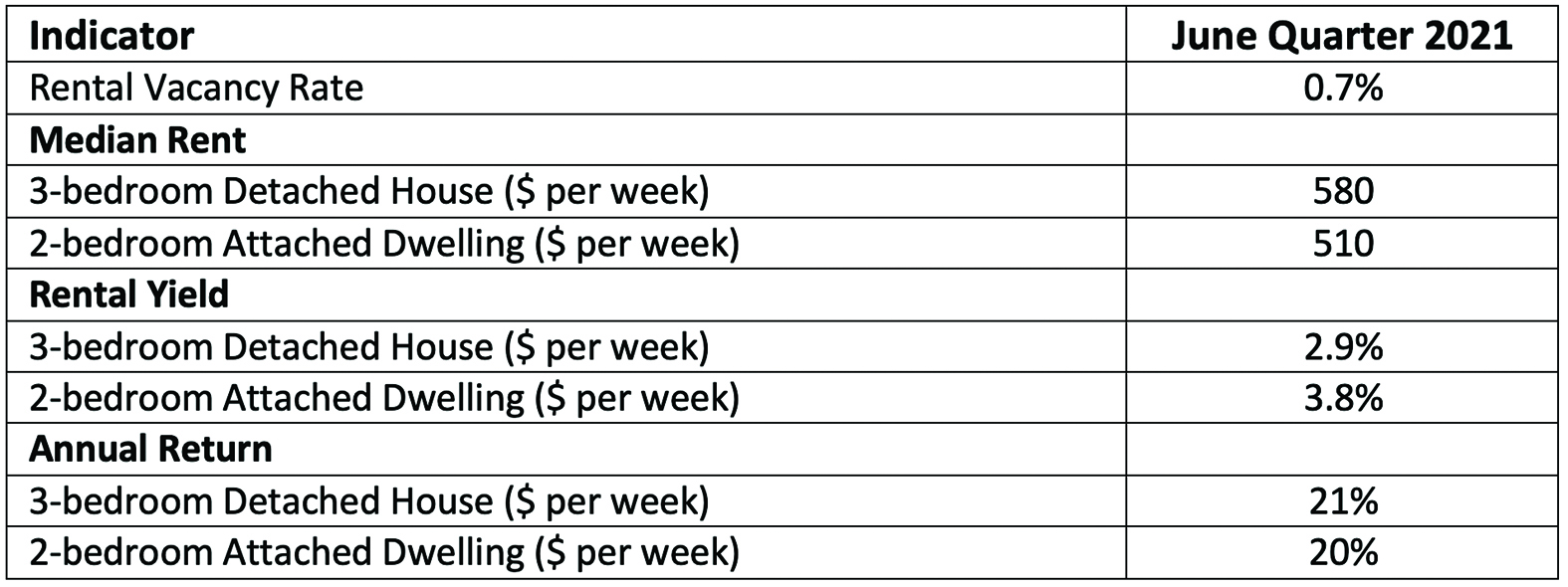

According to a recent ACT government report, in the June quarter 2021, the median rent for detached and attached dwellings in Canberra was the highest of all capital cities in Australia. The rental vacancy rate has also dropped in Canberra from 1.1 per cent a year ago to 0.7 per cent, which is the lowest rate of any capital city.

The deterioration in rental affordability in Canberra was, considering the ACT government’s land and housing policies, entirely predictable and should come as no surprise to anyone, least of all any member of the government.

One can assume that the owners of investment properties will, understandably, always seek to maintain rental yields, so the increase in the median house price since 2011-12 will, by itself, have added between $250 to $330 a week to rents.

In addition, land tax, which is discriminatory in that it is applied only to rental properties, has increased over that period by $3250 for a median house.

As an aside, despite the government agreeing in principle, a decade ago, to abolish land tax, in its recent Budget it actually provided for an increase in the tax rate and revenue from land tax.

The decision of the government to continue to levy this tax, in a supply constrained market, has clearly not discouraged investors from the housing market. In fact, most landlords have likely passed the increases in the tax directly to tenants. The table is a snapshot of rental yields and returns in the Canberra housing market.

With annual returns from investments in housing far exceeding those in alternative investment markets, tax policy changes, at either the state or national level, are unlikely to free up investment stock for homebuyers. Indeed, the Budget papers report a strong increase in new housing loans by investors over the year to July.

With annual returns from investments in housing far exceeding those in alternative investment markets, tax policy changes, at either the state or national level, are unlikely to free up investment stock for homebuyers. Indeed, the Budget papers report a strong increase in new housing loans by investors over the year to July.

It is accepted, obviously, that the housing market clearly does not meet the needs of all households. In response, the Commonwealth government assists eligible households, through the Commonwealth Rental Assistance (CRA) program, in meeting the prevailing market rent.

At the state and territory level, public housing, and community housing – collectively called social housing – are meant to provide appropriate access to rental accommodation for mainstream households without the means to access the rental market.

- In the 2015-16 Budget, the ACT government announced a $133 million investment in public housing.

- In the 2016-17 Budget, the government allocated $156 million for that year and a further $353 million over four years to public housing.

- The 2017-18 Budget committed $57.1 million “to continue the single largest renewal of public housing in the territory’s history”…

- While in the 2019-20 Budget, the government announced: “The next stage of investment in public housing by investing $100 million over five years”.

- In the 2021-22 Budget, the government has allocated an additional $100 million over four years, with the bulk of it ($80 million) for maintenance of the existing stock.

While it is admittedly not clear where or how or if these large, claimed investments in public housing, approaching in total $1 billion have been made, Canberrans would be justified in believing that the government takes seriously its responsibility for those unable to purchase a home or enter the rental market as affordability has deteriorated.

The reality suggests otherwise. ACT Housing has reported that it held 11,859 dwellings in 2011. According to data recently published by the Australian Institute of Health and Welfare (AIHW), that dwelling stock declined, by 2015, by a total of 1026 dwellings to 10,833.

Notwithstanding the funding announcements in every Budget since 2014-15, and referred to above, in 2020, there were, according to the AIHW, 10,985 public housing dwellings in the ACT, that is 874 less than in 2011.

What this reveals is that the purported “investment” in public housing is yet to replace the housing stock lost through the re-development of the Northbourne corridor and in sites including Civic, Griffith and Red Hill, which resulted in the relocation of more than a thousand households from their communities and services.

According to the Australian Bureau of Statistics, the ACT’s population was 367,985 in June 2011 and that it increased to 432,380 in June 2020. Therefore, while the population increased by more than 63,000 people, on the data available to us, it appears that public housing stock in Canberra has declined, in that same period, by 874 dwellings.

We find any reduction in the stock of public housing incomprehensible let alone a reduction, in real terms, of this magnitude and wonder how other Canberrans rationalise our collective view of ourselves as a caring and progressive community with this policy.

Next week: community housing

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply