Chalmers’ more cautious assumptions and the enthusiasm with which Gallagher has embraced cost-cutting paint a weak picture of the year, writes PETER MARTIN.

TERRIFIED by the prospect of further stoking the worst inflation in three decades, Treasurer Jim Chalmers and Finance Minister Katy Gallagher have delivered a budget that takes out of the economy about as much as it pumps into it.

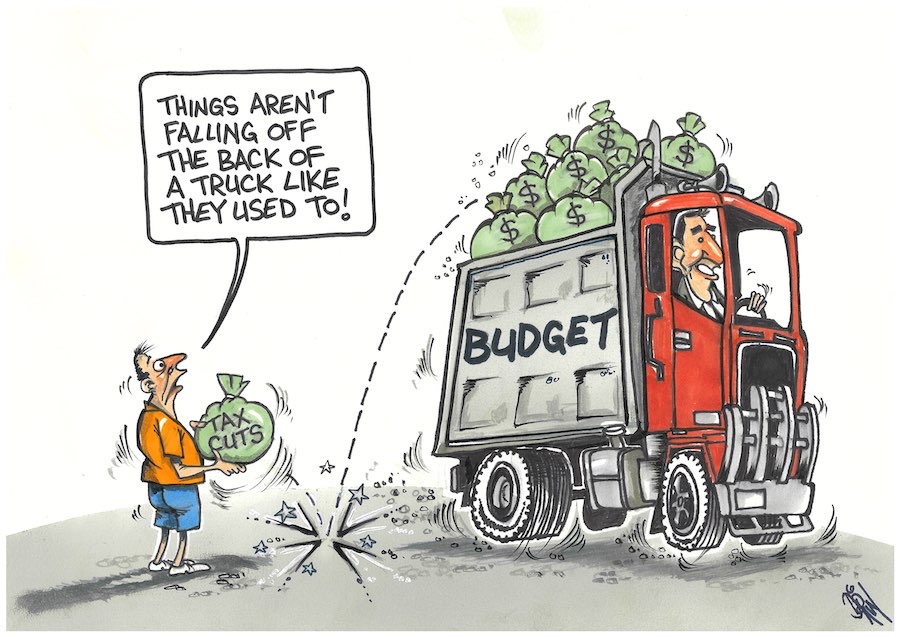

In the March 2022-23 budget, delivered ahead of the May election, the Coalition gave away most of the extra A$40 billion that was to flow from higher commodity prices and an improved economy in new programs and tax cuts. But this budget has hung on to the bulk of what’s turned out to be an extra $52.5 billion.

Over the four years to 2025-26, Chalmers forecasts $144.6 billion more in tax than was expected in March. Most of this is from much higher company tax flowing from higher mineral and gas prices. This is offset by $92.1 billion in extra spending, mainly necessitated by higher inflation.

Out of the net $52.5 billion he plans to spend only a net $9.8 billion, most of which is $7.4 billion in recovery funding for communities affected by disasters.

Labor has largely paid for its election spending promises (all of which appear to have been implemented in full) by hacking into Coalition programs and spending announced in the March budget that hasn’t yet taken place.

Although the monthly measure of inflation has been falling – to 6.8 per cent for the year to August (with the September update due on Wednesday) – the budget forecasts a reacceleration to a peak of 7.75 per cent by the end of the year.

It expects retail electricity prices to climb by 20 per cent this year and a further 30 per cent in 2023–24. It expects retail gas prices to climb 20 per cent in both years. It says these higher prices should flow through into the cost of almost everything we buy.

Nevertheless, as international price pressures ease and as higher Reserve Bank interest rates squeeze spending, it expects inflation to fall back to 5.75 per cent by mid next year, 3.5 per cent by mid-2024 and (perhaps optimistically) to the middle of the Reserve Bank’s 2-3 per cent target band by mid-2025.

Encouragingly, it expects wage growth to accelerate almost immediately, from its present 2.6 per cent to 3.75 per cent by the middle of next year, taking wages growth back up above prices growth of 3.5 per cent by mid-2024.

Whether or not this slow glide down from higher inflation and quick lift in wages growth is realistic, many of the assumptions in Chalmers’ first budget are more believable than those of his predecessors.

Previous budgets made their forecasts look better by plugging in high productivity growth of 1.5 per cent per year, which has been the average over the past 30 years. But productivity growth hasn’t been anything like that high for two decades. On average it has been 1.2 per cent, which is the much lower number Chalmers has plugged in, cutting forecast economic growth by 1.75 per cent over the next decade.

The previous budget expected the National Disability Insurance Scheme to cost $46 billion per year by 2025-26. This budget expects it to cost $51.7 billion in the light of new actuarial projections, pointing to spending increases of 14 per cent per year.

The previous budget expected net interest payments to amount to 0.8 per cent of gross domestic product by 2032-33. This budget factors in almost double the cost – 1.5 per cent of GDP – as a result of much higher interest rates.

By 2025-26 it expects interest payments to cost $26.5 billion, which is more than it expects to spend that year on family payments, pharmaceutical benefits, or schools. It expects net debt of 31.9 per cent of GDP by June 2033, well up on the 26.9 per cent expected in March.

As is a Treasury tradition, the revenue forecasts are conservative. Whereas the March budget assumed iron ore, coal and gas prices would fall from exceptionally high levels to long-term averages by September 2022, the October budget assumes the same fall, but for March 2023.

In truth it’s hard to tell what will happen six months into the future, let alone the four years for which the budget makes forecasts and the ten years for which it makes projections, as what’s happened since March makes clear.

But taken together, Chalmers’ more cautious assumptions and the enthusiasm with which Gallagher has embraced cost-cutting paint a weak picture of the year. Economic growth is forecast to be 3.25 per cent this financial year, down from 3.5 per cent forecast in March.

Next financial year it is expected to be 1.5 per cent down from 2.5 per cent forecast in March (albeit while countries including the United Kingdom and the United States grapple with recessions).

Unemployment is expected to be much higher than forecast in March – 4.5 per cent instead of the 3.75 per cent by mid 2024, which would mean an extra 100,000 or so people out of work.

It’s a price Chalmers and Gallagher seem prepared to pay if it means getting on top of inflation, although it wasn’t one they were prepared to draw attention to.

The budget papers say employment will climb in each of the next four years, and doubtless it will, because the population will climb, but isn’t a particularly strong claim to make.

![]()

Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University. This article is republished from The Conversation.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply