“The most significant contribution to the increase in taxation revenue is from stamp duties that were meant to be abolished and/or have adverse impacts on low-to-moderate income Canberrans,” say JON STANHOPE & KHALID AHMED.

WHEN releasing the 2022-23 ACT Budget Review, Chief Minister and Treasurer Andrew Barr advised that the budget bottom line had improved by $21.5 million compared to the original Budget estimate for the year.

He also advised, via press release, that the “deficit is forecast to be lower in every year of the forward estimates and over four years this is a cumulative improvement of $261.3 million”.

Mr Barr further advised: “A key factor in the improving Budget outlook and health of the Territory’s fiscal position is our nation-leading employment and wage outcomes.

“The government is systematically reducing debt over the long term, while also strategically investing in infrastructure that is built for Canberra to ensure that our city continues to be one of the most liveable in the world.”

While these assertions are clearly problematic, what is perhaps more remarkable about the chief minister’s media release is the absence of any serious attempt at explaining the basis of the change in the Budget estimates from those published some months earlier.

There is, indeed, an improvement of $261.5 million in the Headline Net Operating Balance (HNOB) over the four years from 2022-23 to 2025-26.

As we have noted previously, Mr Barr is the only treasurer in Australia to utilise this measure when reporting on the Budget bottom line. The improvement in the Net Operating Balance (NOB) under the nationally accepted and more rigorous standard is in fact $355.4 million, with the $93.9 million difference reflecting a decrease in the returns on superannuation investments from those forecast in the original budget.

However, even allowing for this improvement, it is drawing an extremely long bow to claim that the ACT’s fiscal position has improved by any meaningful measure.

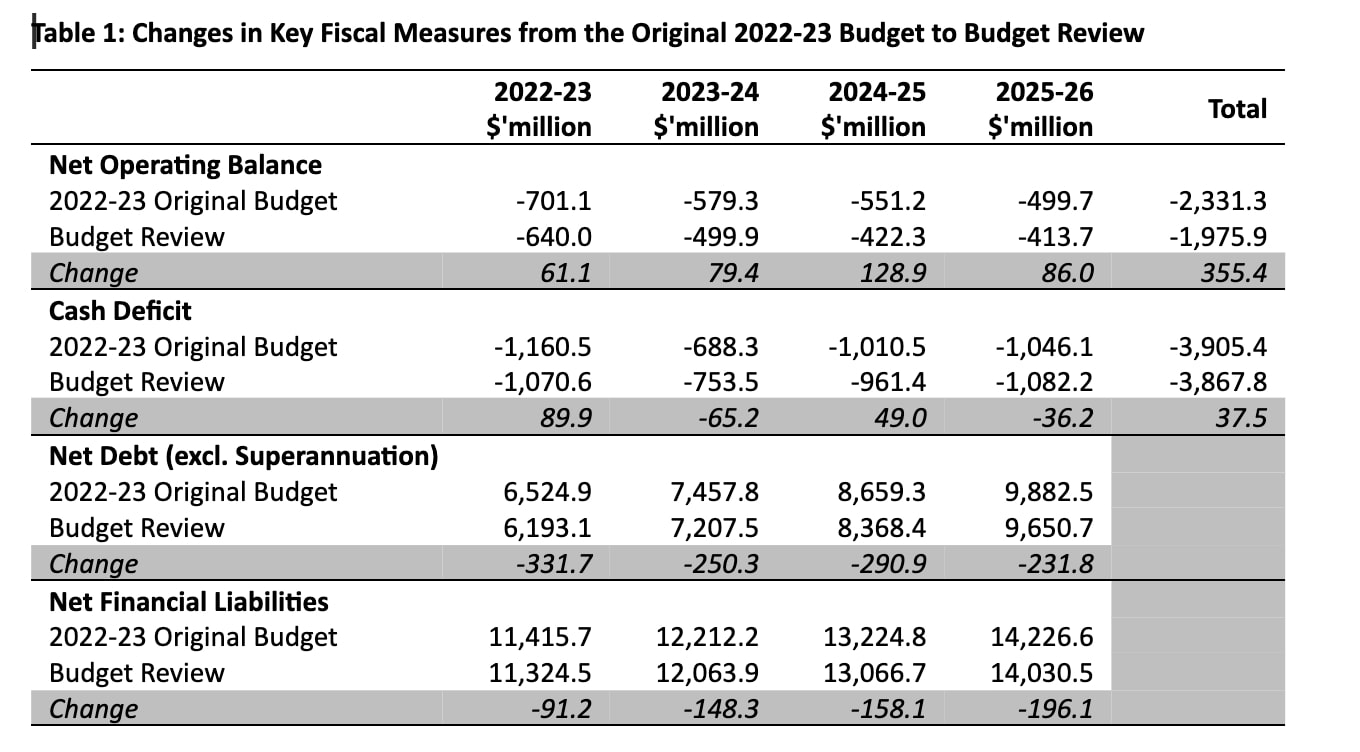

Table 1 provides the original Budget forecasts and Budget Review updates for key fiscal metrics.

It is notable that the operating budget, notwithstanding the improvement, and even accepting that the revised forward estimates will hold, remains in deep deficit.

The NOB deficits in the original Budget averaged 7.9 per cent every year, over the four years. With the revised forecasts, NOB deficits average 6.5 per cent per annum. The forecast deficit for 2025-26 is 5.1 per cent, which is almost the same as the deficit in 2018-19, before the pandemic.

To put the ACT Budget in perspective, every jurisdiction in Australia, other than the ACT, is forecast to be in surplus by 2025-26.

Cash deficits are forecast in the Budget Review totalling $3.868 billion over the four years of the Budget and forward estimates period compared to $3.905 billion forecast in the original Budget, a marginal improvement of $37 million.

Net debt is now forecast to reach $9.651 billion in 2025-26 compared to the forecast of $9.882 billion in the original Budget. However, interest costs on the debt are forecast to increase to $518 million in 2025-26 compared to the $502 million forecast in the original Budget.

These measures hardly suggest improvement in the health of the ACT’s fiscal position as claimed by the chief minister.

The blunt fact is that the operating Budget is now forecast to return to the pre-pandemic level of deficit, in excess of 5 per cent of the Budget, ie about $400 million, by the last year of the forward estimates. Compounding the deterioration in the overall fiscal position is the planned annual increase in debt of about $1 billion every year.

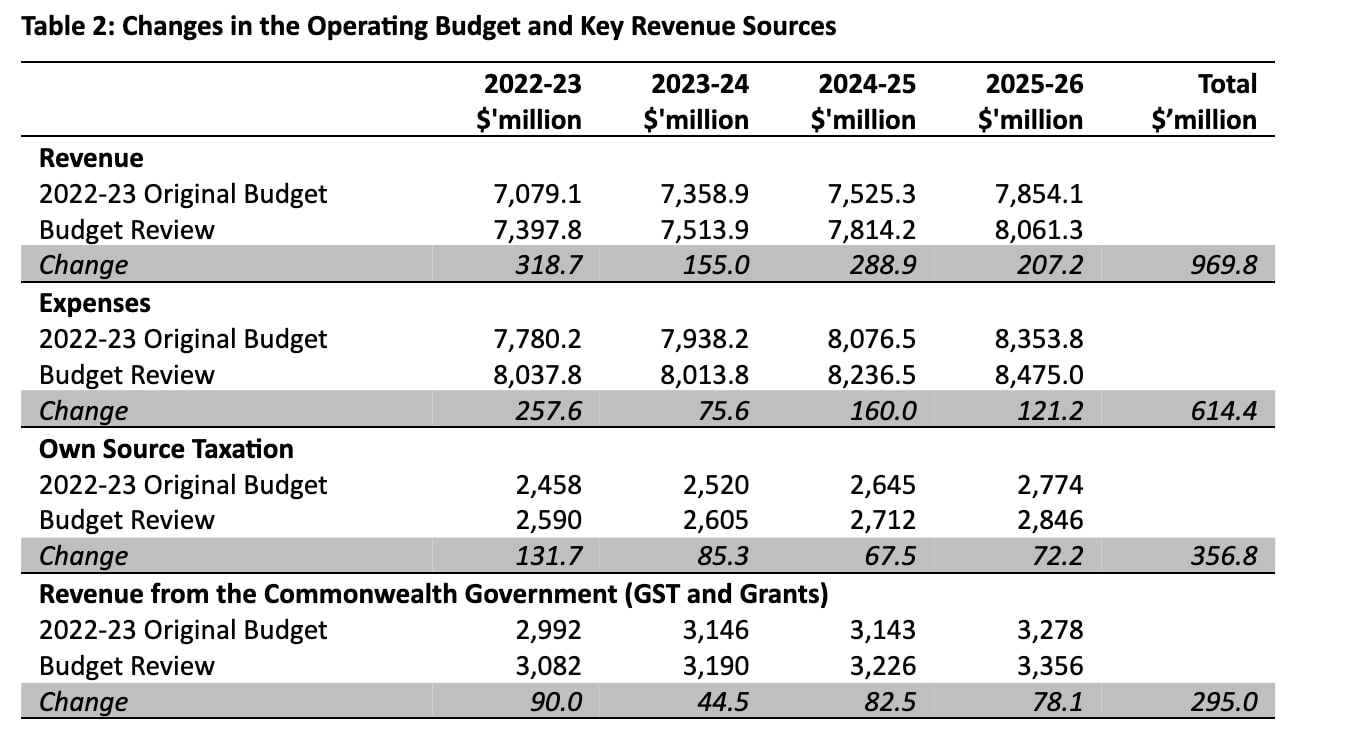

It is revealing to examine the changes in revenue and expenses that underpin the changes in the fiscal aggregates. Table 2 provides changes in the aggregate revenue and expenses and key revenue sources, namely, own source taxation and revenue from the Commonwealth.

Remarkably, revenue is forecast to increase by $319 million in the current year and $970 million over the four-year forecast period. Expenses increase by $258 million in the current year, and $614 million over the forward estimates period.

The Treasurer’s media release attributed the improvement in the Budget position to “our nation-leading employment and wage outcomes”. However, the Budget papers disclose that of the key drivers of revenue, own source taxation, contributed $357 million (37 per cent) to the forecast increase in revenue, while GST payments and Commonwealth grants comprise $295 million (30 per cent) of the increase.

Examination of the changes in individual tax receipts reveal facts that we believe should be of embarrassment to the government.

The most significant contribution to the increase in taxation revenue is from taxes that were meant to be abolished and/or have adverse impacts on low-to-moderate income Canberrans.

Conveyance (stamp) duty – a tax that was meant to be abolished but has in fact almost doubled under the government’s taxation “reform” – will increase by $56 million from the Budget estimate, delivering $417 million in 2022-23.

The government will also pocket an extra $17.4 million in the current year from land tax on rental properties, all of which is almost certain to be passed on to the tenants who are already paying the highest rents in Australia.

Land tax will increase to $214.8 million in 2023-24, an extra $32.2 million compared to the previous forecast, and triple the amount collected in 2012-13 when the government first agreed in principle to abolish it.

The combined effect of interest rate rises and increases in land tax are certain to exacerbate the financial stress already experienced by thousands of rental households.

The assertion in the treasurer’s media release regarding Canberra being the most liveable city may be true for some people.

However, with the worst public hospital system in the country, the worst outcomes for the most disadvantaged groups, the highest rents in the country, a degraded public transport system and declining public housing, many people will not only disagree but will find such a claim reflective of their government having forgotten them.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply