Canberrans have copped the nation’s highest increase in tax over the past decade and it’s not likely to change. JON STANHOPE and KHALID AHMED continue their forensic look at the latest ACT budget.

THE media release from Chief Minister and Treasurer Andrew Barr that accompanied the 2023-24 budget contained this rather odd claim: “Total revenue has increased by greater than total expenses over the three years from 2023-24 to 2025-26 compared to the 2022-23 Budget Review.”

What is odd is that the Budget Review had already forecast an improvement in the operating budget – that revenue growth would be greater than the increase in expenses over the forecast period.

Similarly, the 2023-24 budget also forecasts an improving bottom line across the forward years.

It’s therefore strange that Mr Barr’s media release combined the sum of the revenues and expenses over three years (from 2023-24 to 2025-26) and then compared them, respectively, with the Budget Review estimates.

Why didn’t he simply state the increase in revenue is greater than the increase in expenses in each of the forecast years, or even more simply, that the Net Operating Balance (NOB) is forecast to improve in each of the years compared to the Budget Review?

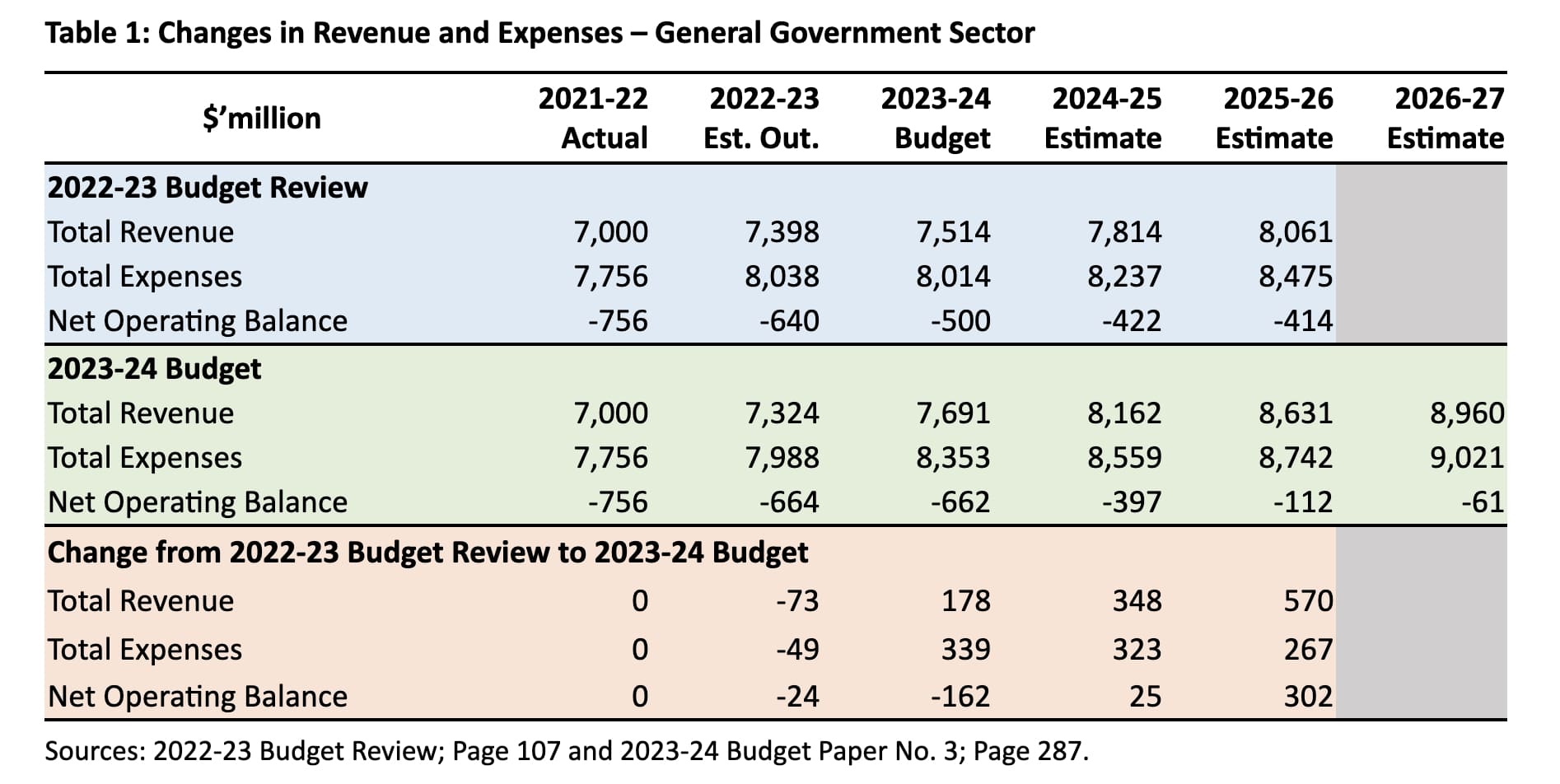

Table 1 incorporates the total revenue and total expenses in the 2022-23 Budget Review and the 2023-24 Budget and the changes in those totals from the Budget Review to the 2023-24 Budget.

Table 1 incorporates the total revenue and total expenses in the 2022-23 Budget Review and the 2023-24 Budget and the changes in those totals from the Budget Review to the 2023-24 Budget.

What it illustrates is the dramatic deterioration in the operating budget position in both 2022-23 and 2023-24 (the budget year) when compared with the Budget Review forecasts.

The change in the forecasts for 2023-24 is particularly revealing in that total revenue increases by $178 million from the Budget Review forecast. The increase is entirely attributable to an increase in Commonwealth grants.

We have previously shown that the forward estimates for expenditure did not provide for sufficient growth to cover inflation and wage growth.

In fact, the 2023-24 forecast in the Budget Review reflected a cut of 0.3 per cent in nominal terms. Considering these cuts, the government had no option but to either increase expenditure or cut services. In the former case, taxes would need to increase, or the operating deficit would be worse than published.

Unsurprisingly, that is what’s happened. Total expenses in the 2023-24 budget increased by $339 million, from the Budget Review estimate of $8.014 billion to $8.353 billion, resulting in a deterioration of $162 million in the NOB to $662 million.

That may explain the omission of any reference, specifically, to the 2023-24 budget position, in Mr Barr’s media release.

While the forecast NOB deficit is essentially the same for 2022-23 and 2023-24, a miraculous improvement of $550 million in the bottom line is forecast over the following two years 2024-25 (election year) and 2025-26. This is largely underpinned by significant revenue increases over the Budget Review forecast, reaching $570 million in 2025-26.

The Budget forecasts revenue growth of 5.1 per cent, an increase from the forecast of 3.6 per cent in the Budget Review – well above the growth rate of the economy whether as measured through Gross State Product or State Final Demand, both averaging 3 per cent and 2.25 per cent per annum respectively.

It’s worth noting that aggregate expenditure growth has been restricted to 3.1 per cent a year across the estimates period.

According to the Australian Bureau of Statistics, over the seven years before the pandemic (up to 2018-19), taxation revenue in the ACT increased at a compounding rate of 7.3 per cent annually, the highest of all the states and territories. The national average annual growth rate was 5.4 per cent.

Including the post-pandemic years, ACT’s taxation growth over the 10 years to 2021-22 has been the highest in the country at 7.4 per cent a year compared to the national average of 6.2 per cent as shown in Chart 1.

What may surprise many Canberrans is that since the treasurer assumed the responsibility for taxation reform, (land) tax on rental properties and stamp duty, two of the “bad” taxes, have grown at 9.3 per cent and 10.9 per cent respectively, every year on average since 2012-13.

What may surprise many Canberrans is that since the treasurer assumed the responsibility for taxation reform, (land) tax on rental properties and stamp duty, two of the “bad” taxes, have grown at 9.3 per cent and 10.9 per cent respectively, every year on average since 2012-13.

In summary, the ACT residents have been subjected to a relatively higher tax burden over the past decade, which has been inefficiently raised and inequitably distributed.

Starting from that position, any increases in revenue will place additional burden on the economy, businesses and households. We will focus on the revenue measures in the 2023-24 Budget in a subsequent article.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply