“Expenditure forecasts in the 2023-24 Budget are illusory and almost certain to be exceeded by hundreds of millions of dollars,” say JON STANHOPE & KHALID AHMED. Treasurer Barr has few choices – cut spending, raise taxes or both. More likely he’ll keep borrowing.

IN a previous article on the 2023-24 ACT Budget, we posed the question whether the forecast improvements in the budget bottom line of more than $600 million over a period of just two years would be achieved.

The bottom line is, of course, the difference between revenue and expenditure, which raises the question, whether revenue is not “enough” or expenditure is higher than it should be.

We noted that taxation in the ACT has grown faster than any other jurisdiction in Australia.

To provide some perspective, if the ACT’s taxation growth was kept at the national average, it would have collected $268 million less in 2021-22. The persistent deficits produced by Treasurer Andrew Barr over the last 12 years relate, therefore, to the expenditure side of the budget.

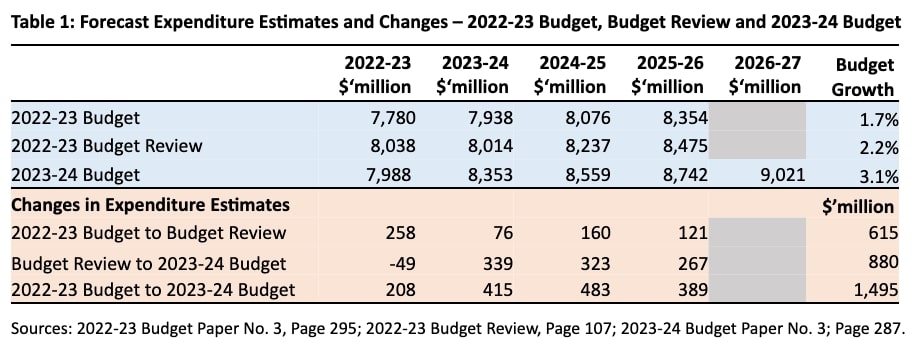

Table 1 provides a comparison of the expenditure estimates in the original 2022-23 Budget, Budget Review and the 2023-24 Budget.

The table reveals that within a few months after the release of the 2022-23 budget, the government added $258 million to the expenditure estimate for the year – in other words a budget blow out.

The growth provided in the original budget was obviously not enough, and expenditure forecasts across the forward estimates were also boosted by $357 million, ie, $615 million in total across the estimates period. Expenditure growth was lifted from 1.7 per cent per annum in the original budget to 2.2 per cent in the Budget Review.

The 2023-24 Budget added a further $880 million to forecast expenditure across the years. While Treasurer Barr’s budget media release reflected that amount it ignored the $615 million that had been added some months before to the 2023-24 Budget. Expenditure growth is now forecast at 3.1 per cent a year.

If this outcome were to be repeated in any of the coming years, the forecast improvement in the operating budget will evaporate, unless the government increases taxation or cuts services – an outcome and a set of options that we had foreshadowed before this year’s budget.

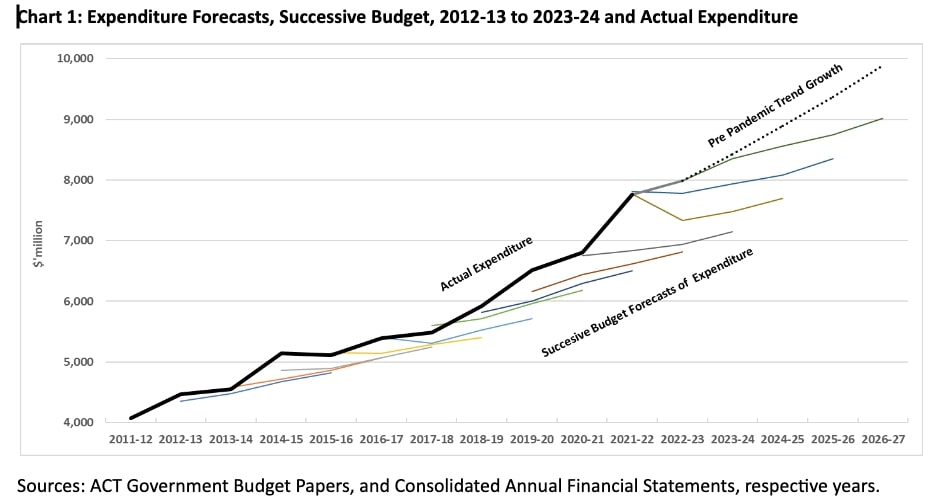

Based on the history of its expenditure management, it is highly likely that there will be budget blowouts and almost certain that the government will not be able to hold its expenditure growth to 3.1 per cent as currently forecast, and as highlighted in Chart 1.

The chart shows budget forecasts of expenditure (thin lines) in successive budgets since 2012-13. The actual expenditure (thick line) has persistently stayed higher, belligerently defying the Treasurer’s stated intentions in successive budgets.

The aggregate expenditure is driven by parameters (such as wage growth, inflation and population growth) and existing policy standards (for example, on response times or wait times) that, combined, result in a “natural” growth rate in budget expenditure.

Any attempt to keep expenditure growth below that natural rate, assuming that service levels and quality are to be preserved, must be based on a realistic plan to achieve efficiency savings. Without such a plan, agencies will either blow their budgets or reduce service provision to remain within budget.

Over the 10 years from 2012-13 to 2021-22, the average overspend against the original budget was $74 million. In the years an overspend occurred (four out of 10), it was by an average of $215 million.

One year out (for example, the 2014-15 forecast published in the 2013-14 budget), the budget forecasts have been understated by an average of $359 million. Three years out, ie, the forecast of the last year of the estimates, has been understated, on average, by a staggering $579 million.

This means that, based on the 10 years of actual results against the budget forecasts, the estimate in the current budget spend of $9.021 billion for 2026-27 is almost certainly understated and, in reality, will be in the order of $9.6 billion.

Is this being unfair? The original estimate for 2023-24 first published just three years ago in the 2020-21 budget was $7.148 billion. The current forecast is $8.354 billion, an increase of $1.206 billion, and we are yet to see the budget review update for this year.

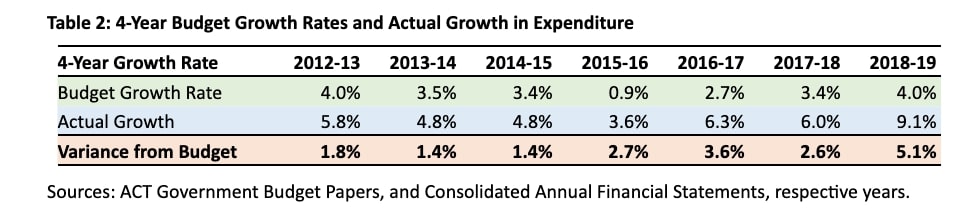

Based on its record, one is entitled to conclude that the ACT government will not hold expenditure growth to 3.1 per cent. Table 2 provides the four-year growth rates provided in successive budgets, and the actual growth rates achieved.

The table shows that over the last decade the government has not once held to the forecast expenditure, with the actual annual growth averaging 2.7 per cent above the forecast. Before the pandemic, expenditure growth averaged 5.5 per cent per annum. If that growth rate were repeated over the current estimates period (trend in Chart 1), expenditure in 2026-27 will be about $850 million above the current forecast.

The lowest expenditure growth achieved in any fopur-year period was 3.6 per cent from 2015-16 to 2018-19. This was also the period during which there were real cuts to health expenditure, a shortage of 150 beds emerged in the public hospital system, and Canberra’s hospital system performance degraded from above average to the lowest in the country.

The crisis in the hospital system was so severe that frontline health staff were forced to publicly raise concerns about patient safety. It was also a time in which the stock of public housing in Canberra continued to be severely degraded.

Because of this history, one is entitled to assume that the expenditure forecasts in the 2023-24 Budget are illusory and almost certain to be exceeded by hundreds of millions of dollars.

It is also almost certain that the forecast improvements in the operating budget will not be achieved, unless the government embarks on a massive savings program, or there are further increases in taxes and charges.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply