“Depletion of cash, unbudgeted borrowings and an equity injection into a joint venture raise some tantalising questions that the government needs to answer.” JON STANHOPE & KHALID AHMED look at another of the Budget Review’s ‘initiatives’.

In a previous article, we urged readers to pare back the spin on the 2023-24 Budget Review initiatives.

Another “initiative” is the injection of funds into the Suburban Land Agency (SLA).

The description of the injection in the 2023-24 Budget Review, on Page 83, says:

Increasing housing access, choice and affordability – Supporting accelerated land release

The government will support the land development and release process by enhancing the capital structure of the Suburban Land Agency (SLA) including:

- providing a one-off $50 million capital injection in 2023-24;

- allowing the SLA to establish a short-term working capital facility; and

- modifying its dividend payment timing to require payment in four even instalments.

These measures will bring the SLA’s capital structure and dividend policy more into line with comparable entities in other jurisdictions and give it more flexibility to respond to risks and opportunities as they arise, as well as maintain prudent liquidity requirements.

This initiative builds on recent government actions supporting increased housing supply and affordability and contributes to the wellbeing domain of housing and home.

This “initiative” and its description beg more questions than it answers. What, for example, has gone wrong with the “land development and release process” that SLA needs government support? Why does a Public Trading Enterprise (PTE) that has delivered more than $1.6 billion in returns to the government over the past six years need money to pay its dividend?

One may, for example, well ask whether this is a case of cycling money from one accounting entity (the General Government Sector) to another (the PTE Sector) as an investment and then recycling it back as a dividend.

A consequence of such a manoeuvre would, of course, be a commensurate improvement in the budget bottom line. But surely not.

The government’s explanation of the initiative in the budget paper, does not, however, have a link to “increasing housing access” or “choice and affordability” or “supporting accelerated land release”. It appears to us as an earnest attempt to identify an initiative with a budget theme that is in reality unrelated to the funding.

However, Treasurer Andrew Barr has doubled down on the claim that the funding is indeed for increased supply to generate more revenue, and that it was purely coincidental that the SLA had made a loss of exactly that amount.

Strange that the funding is needed so urgently

No land or housing supply targets were provided as part of the documentation supporting the supplementary appropriation bill – for those we will need to wait until the 2024-25 Budget.

It is disconcerting that the Legislative Assembly has been asked to approve an allocation of public money without any tangible targets or a specific target.

It is also very strange that the funding is apparently needed so urgently that it is sought through a supplementary appropriation bill despite Mr Barr’s claim that the mooted increase in supply will be at an unspecified time in the future.

In addition, why does the SLA need an injection of money in order to increase supply?

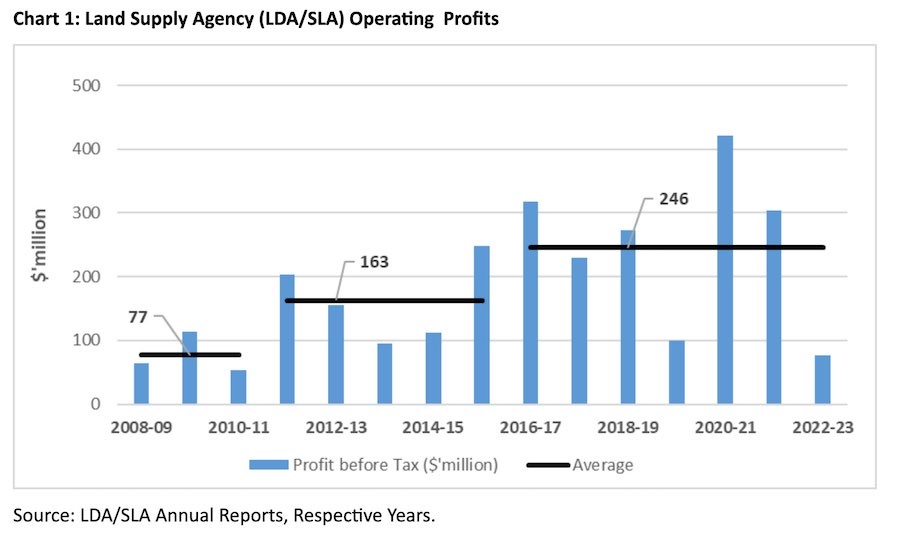

The Suburban Land Agency (and its predecessor land-supply arm) has delivered substantial revenues to the government. Chart 1 shows its operating profits since 2008-09.

The chart highlights three regimes with markedly different levels of profit. Operating profit averaged $77 million over the financial years ending June 2008 to 2011, more than doubling to $163 million on average during 2012 to 2016, and more than tripling to $246 million from 2017 onwards. Over the period 2011-12 to 2022-23, the SLA has posted profits totalling $2.533 billion.

Total returns to government, which include taxes and payments for land acquisitions, are even larger. Over the last six years (2017-18 to 2022-23) alone, operating profits were $1.403 billion and total returns were around $1.647 billion.

One would expect that the SLA would be awash with cash, or at least hold enough cash to meet its short-term financial obligations. However, a cursory glance through the financial statements indicates that the agency did not have enough cash to pay its dividend, and that it is experiencing liquidity problems that appear to have emerged during 2023-24 (the current year).

“Current ratio” is an entity’s ability to meet its current (short term) liabilities through its current assets (cash, receivables and inventory). The SLA’s current ratio at the end of 2022-23 was 1.31, which means it had more than enough liquidity to meet its current liabilities (including payment of dividend).

The 2023-24 Budget forecast a ratio of 1.11 at the end of June 2024. However, the Budget Review update forecast reflects a current ratio of just 0.88, even after incorporating the $50 million capital injection into the accounts.

So what’s driven this dramatic change in the SLA’s liquidity? Its cash holding has dive bombed from the original end June 2024 estimate of $109 million to a revised $27 million. Current inventories, which all else being equal, would have been expected to increase, have also dramatically decreased from the original forecast of $230 million at end June 2024 to $111 million.

Tantalising questions the government needs to answer

We note Budget Review statements for the SLA also reveal, albeit without explanation, an unbudgeted borrowing of $20.6 million in 2023-24 to be repaid in the same year. The agency will also make an equity contribution of $19.6 million in 2023-24 to the West Belconnen Joint Venture. This will be in addition to a $17.9 million equity contribution made by the SLA on behalf of the ACT government. We also note, without comment, that in 2022-23 the JV made a loss of $5.08 million.

Depletion of cash, unbudgeted borrowings and an equity injection into a joint venture raise some tantalising questions that the government needs to answer.

Notwithstanding the real reason for the funding, Mr Barr’s desire to supply more land in the coming years would be commendable, if only it were genuine, credible and realistic.

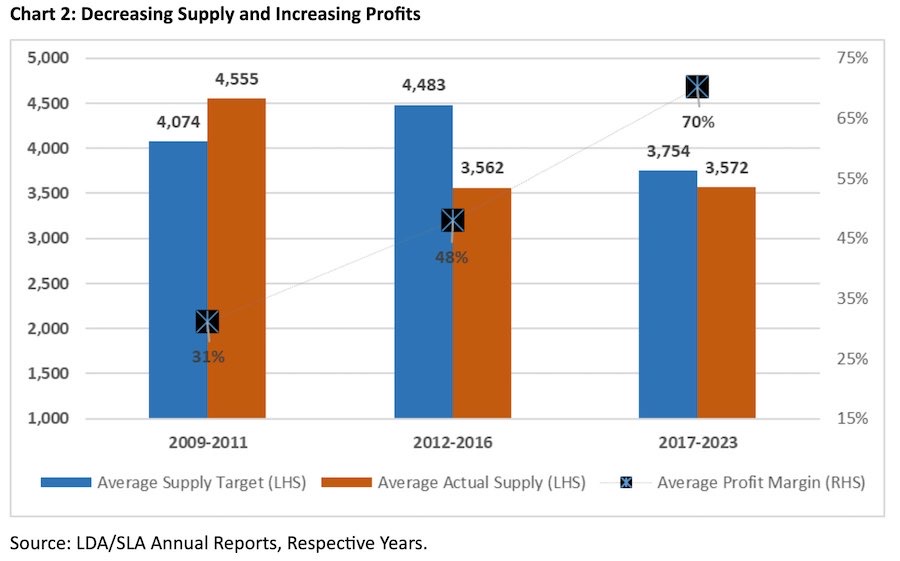

The ACT government’s policy stance on land supply over the last decade has, unarguably and sadly, been to extract as much revenue as possible out of the land supply system through constraints on supply with resultant supernormal profits as highlighted in Chart 2.

Households who purchased land in the ACT sometime over the last decade, and particularly those who entered the housing market in the last six years, should be readily able to estimate how much higher their mortgage is than it reasonably should and could have been.

Remarkably, over the past 10 years, land supply has averaged just 3570 blocks annually, well below previous levels. Land prices now are beyond the reach and capacity of most households seeking to enter the housing market.

There is one clear and indisputable reason that the SLA has been unable to sell enough land to meet demand, falling short of its target, as it has, by almost 2300 sites in the last two years.

If the ACT’s Labor/Green Coalition government is serious about meeting the national housing supply targets, it will, as a first step, need to abandon the monopolist extractive policy that it has pursued over the past decade.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply