“What’s notable is a complete absence of a coherent and simple explanation of what has driven the government to add about $100 million a year in new expenditure.” More forensic revelations of the ACT budget from JON STANHOPE & KHALID AHMED.

Following release of the 2023-24 Budget Review, there was public commentary, to the effect that the larger-than-forecast deficit was a result of lower revenue, and that the goods and services tax, which is collected and distributed by the Commonwealth, was the main problem along with a shortfall in payroll tax.

However, as we pointed out last week, of the total blowout of $719 million over the budget and estimates period, a mere $99 million (14 per cent) was due to a decrease in revenue, while $620 million (86 per cent) of the blowout resulted from an increase in expenditure.

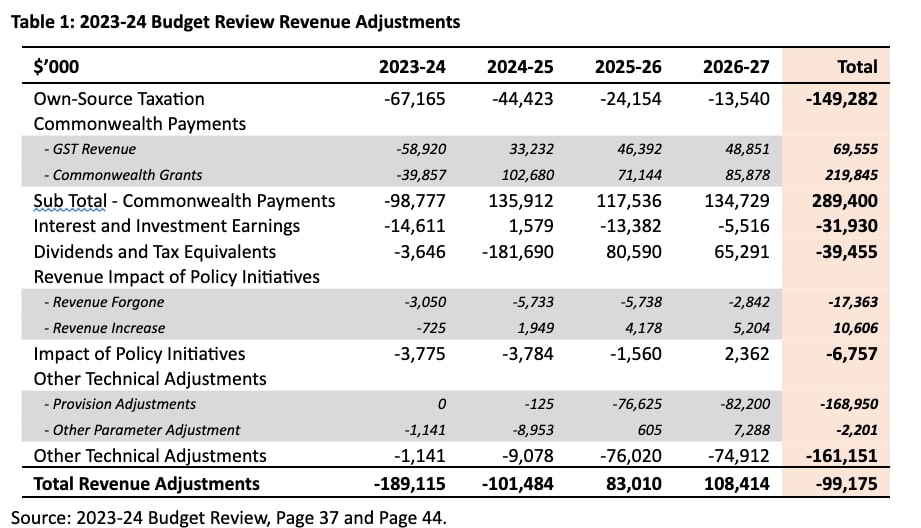

Table 1 details the revenue adjustments discernible in the Budget Review document. For the current financial year (2023-24), a decrease in Commonwealth payments is the largest contributor (52 per cent) to the overall drop in revenue of $189 million. Decreases in own-source taxation (36 per cent) and interest earnings (8 per cent) are the other significant contributors. Across the full estimates period 2023-24 to 2026-27, however, the picture is quite different.

Table1 and the government’s claims raise several quite serious questions.

The original 2023-24 budget incorporated extraordinary growth in payroll tax.

The Commonwealth Government’s intentions to cut and shift expenditure on consultants to build in-house capacity was no secret at the time the budget was delivered.

The Chief Minister and Treasurer, Andrew Barr, often boasts about his excellent relationship with the current federal government. A relationship of an order that he insists he was unable to forge with the previous Liberal government.

It is inconceivable, with all the ACT members of the parliament, other than independent Senator David Pocock, but including the Minister for Finance, Katy Gallagher, who was previously the ACT Treasurer, belonging to the ALP, that Mr Barr was apparently unaware of the potential revenue impacts of the Commonwealth’s policy.

In our opinion, the decline in own-source revenue simply reflects poor forecasting by the treasurer, rather than some unforeseen unfolding of events.

Revenue from the Commonwealth, comprising GST payments and Commonwealth grants, delivers an additional $289.4 million over the estimates period, net of the $98.8 million drop in the current year.

In fact, Commonwealth payments more than offset the decrease in own-source taxation – and yet, the operating budget nevertheless deteriorates across the estimates.

Interest earnings are forecast to decrease by $31.9 million. This adjustment has been reported as a parameter change, however, it is due to a decrease in the cash balance, rather than a change in interest rates. We do not wish to be overly pedantic but note that the lower cash balances are due to decisions deliberately taken by the ACT government to increase expenditure, as reflected in the Budget Review.

Unexplained technical adjustments and “provisions” form the largest downward revision in the Budget Review document.

Provision adjustments for revenue are particularly unusual and hence somewhat mysterious. Typically, provisions are made in the expenditure budget where the costs may not have fully crystallised. Unjustified provisions are often referred to as “hollow logs”. Revenue estimates should in principle reflect declared current policy and forecast parameters.

A negative adjustment to revenue provisions may mean that a previously undisclosed (and not legislated) increase in taxation is being reversed. Alternatively, it is possible that a provision is now being made for, as yet unannounced, future tax concessions. In the absence of any explanation, we are unable to conclude whether this is a case of a budget black hole being removed or a hollow log being created.

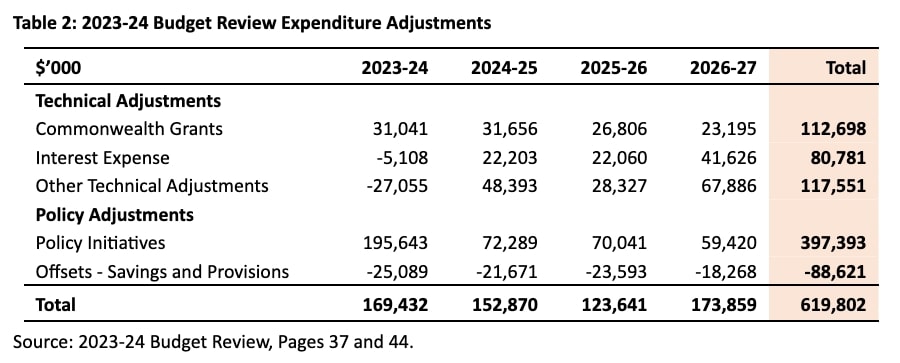

Table 2 combines the expenditure changes from different parts of the Budget Review document with consistent sign convention to present a comprehensive picture.

Increased Commonwealth grants of $219.8 million (Table 1) have tied spending requirements of $112.7 million. This expenditure increase can accordingly be regarded as a technical adjustment.

However, it would be considered creative to call the increase in interest expenses, totalling $80.8 million a mere technical adjustment. The increase in interest costs is a direct result of the skyrocketing increase in the ACT’s debt and the loss of our credit rating. These costs are a direct consequence of the government’s fiscal policy of deficits financed by debt, and its (non-existent) debt strategy.

New policy initiatives total $397.4 million, with a net cost of $308.8 million once savings and provisions offsets are considered. Descriptions of the policy initiatives run over some 45 pages in the Budget Review document.

We have not reviewed the merits of individual budget initiatives. For those interested in doing so we suggest you first attempt to pare back the spin that has become a hallmark of ACT budget papers.

For example, on Page 87, an initiative titled “Sustaining Public Transport – Keeping fares low” is presented with the following description: “The government will ensure that transport fares remain low by providing additional funding to Transport Canberra to meet increased operating costs. This initiative contributes to the wellbeing domain of access and connectivity.”

The initiative provides an additional $11.692 million in 2023-24, but nothing in the forward years. In effect, the funding is required to plug a budget blowout, presumably due to the original estimate being far too low.

There is additional funding for health to meet the operating costs of the new facility at Woden, which incidentally is being delivered almost a decade later than first recommended. Regardless of that, it is difficult to understand why the money was not allocated in the original budget.

Overall, what is notable is a complete absence of a coherent and simple explanation in the Budget Review of what has driven the government to add approximately $100 million a year in new expenditure across the forward estimates.

Jon Stanhope is a former chief minister of the ACT and Dr Khalid Ahmed a former senior ACT Treasury official.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply