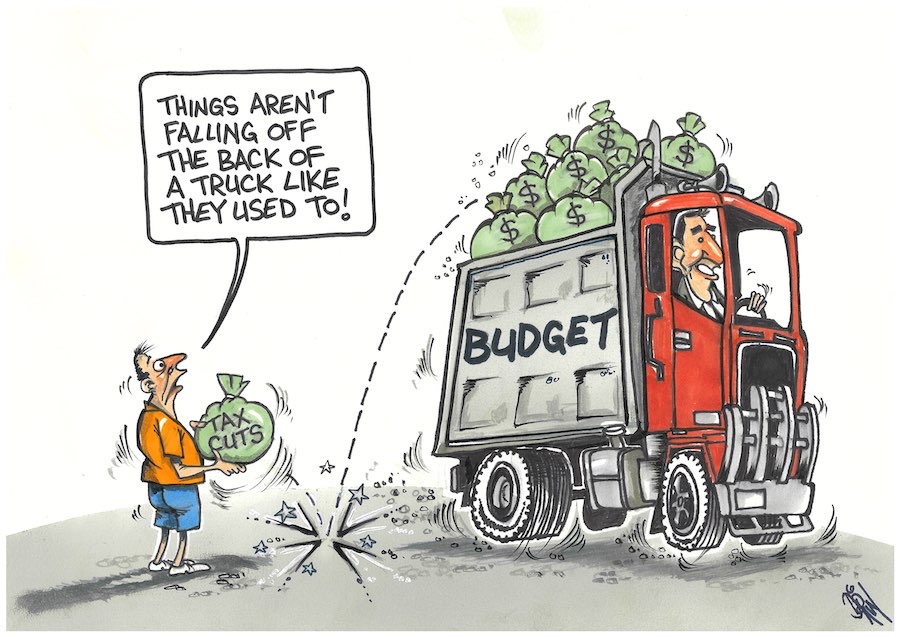

TAX reform and private-sector stimulation sit front and centre of the ACT Government’s last Budget before the October election.

“It’s not a seat-warming Budget,” the Chief Minister Katy Gallagher brightly professed to journalists in the media lock-up at the Legislative Assembly building. Nor, she said, was it an election budget.

“We will not go down the path of slash-and-burn budgeting,” Treasurer Andrew Barr, said of his debut Budget, by way of explaining the Government’s decision to increase the deficit in 2012-13 to $318.3 million.

The deficit is projected to be $130.2 million in 2013-14, and $51.3 million in 2014-15. It’s not expected to return to surplus until 2015-16.

“The current surge in national economic activity, while welcome, is in sectors that do not contribute to the GST pool. And because of lower nationwide consumption, that pool is shrinking,” he told the House of Assembly.

“The Commonwealth’s recent Budget was constructed against this backdrop, and the spending decisions in that budget have knock-on implications for every State and Territory.”

These external factors, including Europe’s continuing, worsening sovereign debt woes and unstable financial markets are having flow-on effects around the world, he said.

The decision to extend the deficit was, he said: “The right decision for this city and this community because it will let us absorb some of the impact of these external factors without risking unnecessary damage to local confidence, local business and local jobs.

“Our measures to grow the private sector, and to reform our taxation system, will indeed ensure that Canberra continues to have a strong and diverse economy.

“The five-year plan I outline today makes the ACT’s taxation system fairer, simpler and more efficient,” he told the Legislative Assembly.

“This plan is revenue neutral – the reforms are not about raising the overall amount of tax the Government receives.

“Many taxes will reduce, some will rise, and several will be abolished.

“The guiding principle has been that households who can least afford it should pay less, and those who can most afford it, should pay more.

“The new-initiatives spend in this Budget is $63.2 million in the 2012-13 financial year and $155.1 million over the four years.

“The 2012-13 capital works budget sees the ACT Government continuing to invest in a robust infrastructure program of over $900 million in 2012-13.”

In announcing a $20 million support package over four years for business, aimed at bolstering the economy and jobs, the Treasurer said: “We are committed to creating an environment in which the private sector can thrive, and we are committed to market-based policies and actions to broaden employment, business activity, growth and investment.

“These things are at the core of the Government’s recent business development strategy – jobs, growth and diversification.

“Importantly, the Business Development Strategy supports a better dialogue between the Government and business, including the establishment of a red tape reduction taskforce, that I will chair.

“In addition to the new funding, is the $30.1 million the Government is investing in cutting payroll tax – a major incentive for businesses in Canberra to grow and for businesses to establish themselves in Canberra.”

While admitting that the ACT was bearing the brunt of the Federal Government’s contraction in spending and employment, Mr Barr also said that his Government could not “save the city from the Federal Liberal Party”.

“And while most Canberrans are prospering, the Government acknowledges some in our community are doing it tough through no fault of their own,” he told the Assembly.

“ACT Labor’s vision is to ensure that the ACT remains the happiest, healthiest, most sustainable community in Australia, with the country’s highest standard of living.

“The decisions taken in this Budget allow us to maintain the Government’s spending and employment.

“This will support our economy at a time when support is needed. It signals the confidence we have in our economy and our labour force. And it will deliver infrastructure that drives productivity.”

Mr Barr said the Government would continue to drive improvement in public service delivery.

“We are making responsible savings in travel, printing, consultancies and advertising. We expect our public service to embrace technological advances and perform their valuable roles more efficiently over time,” he said.

“Building on the work of the Hawke Review, our next step is to position the public service to achieve even greater value for money, provide even higher quality services, be innovative and manage change effectively.

“In order to achieve this, we will establish an advisory group from industry, community and government to assist Cabinet decision making on public sector reform.”

He said the Budget continued to fund programs and services for Canberrans with disabilities, children and young people at risk, and older Canberrans.

“To ensure everyone has access to quality and timely emergency care, we will increase funding for the ACT Ambulance Service, with an additional $9.5 million over four years and almost $4 million for new, modern on-board equipment,” he said.

“We will also be investing in a new fire station at Charnwood and in an upgrade of phone systems to better support triple-zero emergency calls.”

In justice, Mr Barr said the Government was investing in making the court system more efficient and in helping the courts address their backlog of cases.

“We will also be increasing funding to the Legal Aid Commission and supporting the relocation of the Women’s Legal Centre,” he said.

Funding of $67.8 million over four years would be allocated for the ‘Transport for Canberra’ initiatives, including improvements to the MyWay system, he said.

The Budget also included funding for town centres and villages.

“The Urban Improvement Fund will provide an additional $22 million to deliver footpath improvements, playground upgrades, improvements to the quality of our sportsgrounds, a dog park in the inner north and upgrades to the Belconnen dog park, and improvements to public toilet facilities across the Territory,” Mr Barr said.

Arts investment included funding for upgrading the Tuggeranong Arts Centre, refurbishing and upgrading the Canberra Theatre Centre and for kicking off phase II of the Belconnen Arts Centre. The Lanyon Heritage Precinct will also get extra funding.

Mr Barr said the Government would also invest $909 million in education and training.

In health, he said, the Budget delivered a record level of investment in of $1.3 billion.

“We are delivering more acute care beds and more hospital-in-the-home beds. There are more beds for Calvary Hospital, new pediatric, high-dependency beds and additional intensive care beds at the Canberra Hospital,” he said.

“We are expanding the Canberra Hospital’s emergency department with new treatment spaces and more beds.”

In sport, he said, there was funding to restore drought-ravaged ovals at Watson, Weetangera and Bonython.

Who can be trusted?

In a world of spin and confusion, there’s never been a more important time to support independent journalism in Canberra.

If you trust our work online and want to enforce the power of independent voices, I invite you to make a small contribution.

Every dollar of support is invested back into our journalism to help keep citynews.com.au strong and free.

Thank you,

Ian Meikle, editor

Leave a Reply